The June 16 announcement that Amazon was buying Whole Foods was the ecommerce shot across the bow that everyone has anticipated for years. Still, the $13.7 billion deal came as a huge shock in the United States; it represented the next stage of the digital disruption that has upended all of retail. Yet in China, this revolution is well underway–and there are plenty of relevant lessons that others need to learn–and learn fast.

In late 2012, two of China’s most successful entrepreneurs made a very public bet on the country’s retail future. In front of a TV audience, Wang Jianlin, the real-estate maven who built his fortune in shopping malls, wagered Jack Ma, president of ascendant e-commerce giant Alibaba, that online shopping would never replace physical stores. Putting up 100 million RMB (about $16 million at the time) of his own cash, Wang bet that in 10 years online consumption would still account for less than half of all retail.

Five years out, it seems the good money is still on Wang. Yes, China’s big three digital titans – Baidu, Alibaba and Tencent (BAT for short) – have eroded brick-and-mortar market share. Insulated behind the Great Firewall from outside competition, these tech disruptors – Alibaba and Tencent focus primarily on e-commerce, while Baidu dominates search – have rocketed over the last decade from obscurity to dominance. They now rank among China’s top 5 most valuable brands, with a collective brand value approaching $200 billion.

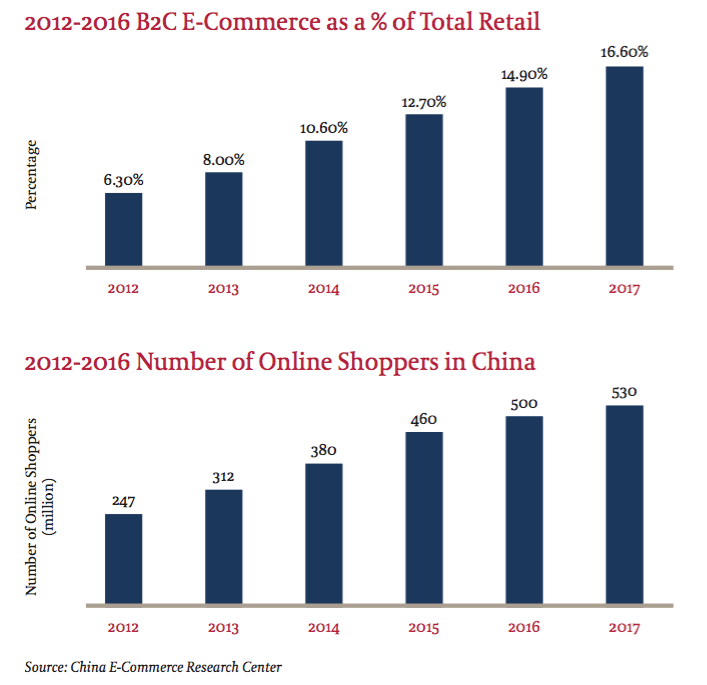

Yet, online sales in China still account for just 15% of all retail, a significant bump from 2012 but hardly a sea change. Despite doomsday warnings, retail in China is not dying. Shoppers continue to demand physical stores – to touch and feel, socialize, ask questions and have an experience that can’t be replicated online. Is it time for retailers and real estate players to breathe a sigh of relief?

No, it turns out – and for reasons that few insiders see coming.

The true threat to retail in China may not be online shopping. It’s the increasing likelihood that the country’s e-commerce giants will turn their attention to doing bricks-and-mortar... better.

Armed with capital reserves, government support and growing troves of consumer data, Alibaba and Tencent have both the means and the motive to redefine traditional in-store shopping. And when they do, existing players in the retail ecosystem – from big box retailers to malls, real estate agencies and developers – may face unprecedented disruption.

This was the primary conclusion from extended interviews Egon Zehnder conducted with leading retail real estate executives and industry insiders over the past four months. Our takeaway: the impact of the online-to-offline (or “O2O”) revolution is being highly underestimated and stands to take legacy retailers almost completely by surprise.

To overcome this blinkered thinking, retailers and developers must immediately change gears – strategically, but also, critically, from a talent perspective. Urgently needed are managers and executives with a strong digital skill set – an understanding of the scope and scale of transformation that’s sorely lacking among today’s retail giants. Without these key people, traditional players will find it challenging to thrive in the years ahead. Some may not survive at all.

The “New Retail” Model That’s Already Here

Starting in 2016, Alibaba’s Jack Ma advocated the concept of “New Retail” – in his words, “the integration of online, offline, logistics and data across a single value chain.” Considering that Alibaba already accounts for more than one-tenth of China’s total retail sales (including 75% of online sales), with revenues surging at an astounding 50% annual clip, the implications of this overture are hard to overstate.

Already, the company is moving fast: In little over a year, Alibaba has gone from opening its first physical store to acquiring a major department store chain, Intime Retail, for $2.6 billion. Yet this is just the beginning.

In February, Alibaba announced a strategic alliance with Bailian Group, the state-owned supermarket, mall and department store chain, which boasts massive amounts of underused retail space in Shanghai and on the eastern seaboard. The new partners will share offline retail branches, merchandising capability, logistics and technology. They are already designing new retail outlets together and developing retail technologies leveraging Alibaba’s unique data and analytics strengths.

Alibaba has also acquired an 18% stake in Bailian’s Lianhua division – some 3,600 supermarkets and chain stores spread across the country, including the well-known Hualian brand. By enlisting big data, Alibaba aspires to do nothing less than reinvent retail – merging online and offline to form a new unichannel “O2O” experience where the notion of e-commerce versus brick-and-mortar seems quaint, if not wholly irrelevant. A pivot to the traditional retail space will enable Alibaba and other digital disruptors to accumulate even more fine-grained data on consumer behavior, which reinforces their online dominance in a positive feedback loop.

“We hope to see chemical reactions. If we can incubate a type of business model that others have never seen, then we are on the right track,” Daniel Zhang, Alibaba’s CEO, explained to a reporter. Commenting on this, the CEO of one big-box retailer said, “It is changing the whole landscape ... It’s a reality which you have to deal with.” Another forward-thinking executive at a state developer who we interviewed pointed out the urgent need for legacy retailers to find ways to cooperate, noting “The reason why brick-and- mortar commerce would want to cooperate with Internet players like Tencent is that standing alone they’re doomed to fail.”

Executed properly, Alibaba’s “New Retail” vision promises not just to remake shopping inside the country, but to leapfrog China ahead of the U.S. and Europe in terms of retail innovation. China is already at the vanguard when it comes to blurring lines between social media, search and e-commerce, with social platforms like Tencent integrating seamless payment and shopping functions, all inside one walled garden.

While Amazon is making tentative inroads into brick-and-mortar in the U.S. through Amazon Go and other offerings, Alibaba’s scale and speed is without precedent. A concerted foray by the likes of Alibaba and Tencent into brick-and- mortar could make the current retail disruptions caused by e-commerce look trifling by comparison. In China, the giants’ quasi-protected status and the inability of international players to gain a foothold only accentuates this trend.

Heads in the Sand

If Alibaba turns its attention to real estate – and is able to gain access to prime assets and design its own unique physical shopping experience using a data-centered approach – traditional developers will be displaced. As it and Tencent harness their own algorithms to identify the perfect blend of stores for their target demographic, commercial real estate agencies could quickly find themselves marginalized. With online players applying big data and machine learning to make in-store experiences more personalized and more convenient, legacy retailers may quickly hemorrhage shoppers. Meanwhile, if malls transition from points of sale to experiential showrooms for sales made online, the whole owner-tenant model – based on a percentage of in-store sales – could be rewritten, disrupting not just individual stores or chains, but the entire retail real estate industry in China.

So far, the prevailing response from legacy retailers to these existential questions has ranged from mild trepidation to outright indifference. Some developers, seeing declining sales in the face of e-commerce encroachment, have worked actively to retrofit their malls more as “experiential centers” – places to browse, linger and try on, not merely to shop. Others are doubling down on the luxury market, which has proved to some degree resistant to online encroachment. Few, however are taking the hard steps needed to stay competitive in a world where online and offline are fast converging. And fewer still are considering the strategic talent implications of this convergence.

Many of our interviewees, including executives from leading real estate and development companies from China, Singapore and Hong Kong, seemed complacent about the looming crisis. They point to the limited market share of online players, as well as the high cost of customer acquisition, as evidence of the finite threat posed by e-commerce. Clinging to the comforting idea that people will always need stores and nothing will replace the physical experience of shopping, many underestimate the potential for further offline disruption. “The worst time for retail is over. The online thing is also a bit over,” one real estate consultancy executive told us. A leading executive at one of China’s largest hypermarkets went so far as to insist, “I am convinced that in the end, online will never be feasible on its own to make any profit.”

A Response for Retail

How can China’s retail incumbents avoid being devoured by today’s disruptors? A look across the industry offers some insight on which solutions may work and which definitely will not.

Wang Jianlin’s own Dalian Wanda Group offers a cautionary tale of retail hubris. After opening hundreds of cookie-cutter department stores and malls around the country in a frenzy of expansion over the last decade, the property developer has closed hundreds in quick succession. Buoyed by its size and considerable institutional resources, Wanda largely ignored the online commerce revolution. Assuming that its consumers were a captive audience, the developer failed to upgrade or customize its properties to drive traffic. Shoppers bolted en masse – moving on to more upscale settings or online alternatives.

Other developers, especially those behind high-end properties on the eastern seaboard, have moved more aggressively to transform their malls into more “experiential” centers. The underlying rationale is to provide consumers with a physical space where they can do all the things impossible online – from eating in restaurants and seeing live entertainment to socializing with fellow shoppers and trying out the latest products in a showroom setting. One senior executive from a large state-owned developer has gone so far as to suggest, “Perhaps in the future, the word “shopping” could be removed from the name “shopping mall,” as people will come to the malls for socializing, for fun, for entertainment – not necessarily for shopping.”

Loyalty programs, which reward in-store customers with points and rebates, are also being embraced as ways to get shoppers to buy in malls, rather than online. Examples include Capitaland’s Capitstar initiative, a multi-store, multi-mall cardless reward program rolled out across Asia.

Surviving and thriving in the face of increased retail competition may depend on taking a cue from the hospitality sector. This requires acknowledging that customers shop not merely for a product but for a distinct and branded experience. Just as the best hotels create loyalty with a unique style and service offering evident from the very first guest interaction, so must progressive malls better define and deliver a branded experience that transcends any one store. In this respect, international developers such as the Kerry Group and Sun Hung Kai are more quickly moving to incorporate a hospitality element to their property management approach. Concierge-like services and customer experience-focused training for every customer interaction point make their properties preferred venues. As noted by a major high-end mall developer based in Hong Kong, “You need to have people to come to spend time in the mall. It’s not so much about just the transactional experience.”

Data Makes the Difference

Yet, these steps alone may do little to mitigate the power and advantages of the disruptors. Ultimately, data – not dining options or bonus points – will make the difference.

Brick-and-mortar-first retailers have traditionally lagged far behind online counterparts when it comes to capturing and applying consumer information to create personalized and streamlined shopping experiences. But progressive retailers are quickly leveling up. The A.S. Watson group, which boasts more than 13,000 health and beauty stores across Asia and Europe, recently committed $70 million to integrate an enterprise data platform into its operations. The system provides unified customer data across the organization and uses machine learning to process big data and enhance customer experiences.

Creative partnerships to share data and technology with online players can also yield results ... at least, in theory. Problems arise because of the asymmetrical nature of most relationships: e-commerce giants, armed with resources and data, often hold all the cards. This can leave traditional retailers in a vulnerable position; unable, unwilling or too cautious to partner. As one high-end mall developer explained, “Of course, they [Alibaba] will always promise they will share back something else, but in the end maybe they won’t do it.”

A large hypermarket chain in China, for instance, was recently approached by Alibaba about a data-sharing scheme. Alibaba offered to provide detailed buying behavior about customers in a 5-kilometer radius of a planned hypermarket – everything from gender to seasonal preferences. In exchange, the hypermarket was asked to share aspects of its own customer database. It declined the offer, because the CEO couldn’t assess whether what it was giving up was worth what it would get.

Alibaba is already showing the real potential of this kind of online-offline hybrid with HEMA, the new Alibaba-backed grocery store, which already has nearly 10 locations in Shanghai and Beijing. Inside, shoppers find a carefully curated selection of 3,000 products from 100 countries, with an emphasis on high-end dining. Consumers can order online through their mobile app and get delivery within 30 minutes, within a 5-kilometer radius. Or, in a true expression of the O2O vision, they can shop in-store. Digital price tags are updated in real time, and shoppers can scan bar codes, pay via the HEMA app and have purchases delivered for free. To emphasize the “experiential” element, HEMA stores also organize special customer events and even offer a dedicated “food booth” zone where shoppers can have their groceries cooked for them.

Meanwhile, detailed shopping behavior, on everything from purchases to movement around the store, is captured via the mobile app. This data gold may be even more valuable than traditional performance indicators like value per order. By bringing online technology for the collection and application of big data into the offline world, Alibaba can ultimately simplify and personalize the shopping experience – creating a competitive edge over traditional retailers which will only intensify.

Leadership in the Retail Revolution

The growth of e-commerce has already jolted some players out of complacency. Progressive retailers are recruiting leaders boasting digital savviness, breadth of exposure, openness to new ideas and higher strategic orientation. At Egon Zehnder, we believe that the most important factor in nurturing and retaining digital talent is organizational culture. Companies and their leaders should consciously build cultures that encourage experimentation and learning, speed and adaptability.

In a traditional offline business, shaping a digitally-ready culture is no small task. It requires customer focus, openness, collaboration, constant learning and the willingness to “fail fast”. It also requires executives to accept both latent and visible threats, even if they cause profound discomfort. This digital talent must be able to question and debate the company’s business model and empower consideration of creative ways to co-create and cooperate with pure-play technology players.

Players who can fully integrate this bottom-up digital ethos – using the right technology in the hands of the right leadership – will thrive in the years ahead. By contrast, the great many players in the retail ecosystem who stick to business as usual may find themselves increasingly disintermediated. A mere five years after Wang Jianlin placed his famous bet on China’s retail future, it turns out the real battle isn’t between online and brick-and-mortar at all. Instead, it’s between old retail and New Retail. And this time around, the luck of Wang – and the legacy retail model he embodies – may be running out.

Hiding in Plain Sight: The Accelerating Disruption of China's Retail Landscape

Download as PDF

This article has previously been published in Fortune