Ultimately everyone dies

Resilience has its price – if you stay around long enough to pay it

There are many ways of dealing with risk – the fatalist, for example, ducks when something is about to hit him, and carries on buying lottery tickets. For THE FOCUS, prominent essayist John Adams looks at the various ways of playing the risk game. Along with a healthy sense of judgment, one of the keys to greater resilience, he finds, is learning from experience. But therein lies the rub: This primary instrument of successful risk management is only available at the price of taking a risk. So the pursuit of resilience is a balancing act, with the ever-present danger of taking a tumble.

by John Adams

RESILIENCE is a relative quality. There are no units by which it can be measured, but some have more of it than others. The ability to prevent bad things happening, and to mitigate their consequences and speed recovery when they do, is not equitably distributed.

It is also limited. Ultimately the pursuit of it ends in failure. Empires collapse, companies go out of business, everyone dies. On a geological time scale tectonic plates shift, ice ages come and go, asteroids impact, the sun goes cold. On a human time scale tsunamis, earthquakes, credit crunches, diseases, and simple traffic accidents can overwhelm the most resilient of individuals. But still we strive to prevent bad things happening, mitigate their consequences and speed recovery.

The pursuit of resilience involves risk management and we can identify three different types of risk with which we all, as risk managers, wrestle.

Risks perceived directly are visible to the naked eye. We manage them using judgment. We do not undertake a formal probabilistic risk assessment before crossing the road. Some combination of instinct, intuition, and experience usually sees us safely to the other side.

Risks perceptible to science can only be identified by those armed with microscopes, telescopes, scanners and other measuring devices, surveys, and the data they produce. This is the realm of quantified risk management. In this realm uncertainty is qualified by probability.

Virtual risks may or may not be real – scientists disagree – but they have real consequences. The uncertainty is liberating; if science cannot settle the issue, people feel free to argue from their beliefs, convictions, prejudices or superstitions. Here we are thrown back, as with risks directly perceived, on judgments that cannot be objectively validated.

This flexible approach to risk can be seen in terms of a risk control-loop or thermostat. The way we deal with risks will be determined on the one hand by our propensity to take risks and on the other by our perception of what constitutes a risk. The outcome of our risk management activities will either be described in terms of success and reward or of failure and loss. The self-regulating factor here is that we learn from experience. Risk followed by reward will impact on our propensity to take risks; failure or loss will alter our perception of what constitutes a risk – revising the rules of the game for the next time around.

Some people’s risk thermostats are set high, others low. I have yet to meet anyone with a zero setting; life would be unutterably boring. Propensity leads to risk-taking behavior that leads, by definition, to accidents. To take a risk is to do something that carries with it a probability of an adverse outcome. Through surviving accidents and learning from them, or seeing them on television, or being warned by mother, we acquire our perception of safety and danger. When propensity and perception get out of balance we behave in a way that seeks to restore the balance. In essence, resilient behavior is a balancing act.

The perils of under- and over-regulation

Most institutional risk management, outside the offices of venture capitalists, hedge fund managers and sub-prime mortgage brokers, is devoted to the prevention of bad things happening. This kind of risk management is focused on just part of the risk thermostat – the control loop comprising perception, behavior and failure, then back to perception. It is risk averse. But as people or societies become more risk averse they do not necessarily become more resilient.

Resilience requires command over resources. Building flood defenses and earthquake-resistant buildings, accident and emergency services, and post-disaster continuity planning are all luxuries that the poor cannot afford. The single-minded pursuit of accident avoidance at all costs severely constrains the pursuit of the rewards of risk, the creation of the resources that ultimately make resilience affordable. So once again, achieving resilience is a balancing act: Too little caution can lead to disaster; too much can kill the enterprise. In one company I know the (overly?) enthusiastic health and safety team is referred to as “the sales prevention department.” Most of the wealthy resilient world is now becoming less resilient. It is suffering simultaneously from under-regulation and over-regulation. The deregulation of the financial markets has given a relatively small number of financiers free rein to contrive incentive structures that pay them fabulous rewards for taking risk-free risks with other people’s money. Meanwhile other spheres of activity are being suffocated by an excess of regulation. The most egregious example in Britain at the time of writing is the Independent Safeguarding Authority. This new bureaucracy, created as a response to the sensationalist media outcry over the murder of two young girls, is charged with vetting an estimated 9 million people before they will be permitted to work, or volunteer with, children or “vulnerable” adults. The vetting involves a Criminal Records Bureau (CRB) check on all 9 million after which, according to the Authority’s website, “we will decide on a case-by-case basis whether each person is suited to this work.”

The value of first-hand experience

Leaving aside the mind-boggling expense and bureaucracy required to perform this feat, its effect is almost certain to be perverse. The bureaucratization of the protection of children shifts responsibility. A CRB check will be seen as an insurance policy; behavior that might previously have aroused suspicion is now less likely to be questioned, or acted upon, because some superior authority has certified the suspect as “safe.” But much worse is the damage that will be done by this extraordinarily disproportionate reaction to an extremely rare event. It is already having an impact on volunteering, in a wide range of activities requiring adult involvement. From music and drama to sports, scouting, field trips, and educational exchanges there can be seen a massive withdrawal of adults unwilling to subject themselves to the cost, inconvenience or indignity of the vetting process.

But there is worse to come. Resilience is a skill acquired through experience. Over recent decades in the United States, Britain, and many other wealthy countries the pursuit of zero risk to children has led to their increasing confinement under adult supervision. Now the loss of adult supervisors is restricting still further the range of activities in which they can engage, leaving them to grow increasingly obese before their TVs and game consoles. Learning through experience the balancing act that underpins resilience is increasingly being denied them.

That brings us to the final factor in our risk management model: As we have seen, rewards and failures influence our propensity to take risks and our risk perception respectively. The extent to which this happens will vary from one person to the next in line with our perceptual filters. A typology of commonly encountered responses to risk, developed in a branch of anthropology called Cultural Theory, defines four types of individual: The Hierarchist represents the institutional risk manager, the maker and enforcer of the rules to which society is expected to conform. The ultra-cautious Egalitarian in the guise of defender of the environment, or its vulnerable inhabitants, commonly argues that the hierarchy is not doing enough to protect us, while the Individualist complains that the hierarchy is over-regulating and suffocating enterprise and individual liberty. The risk management strategy of the poor benighted Fatalist – who is most of us most of the time – is to duck if he sees something about to hit him, and carry on buying lottery tickets.

Rewards for high-wire artists

There is a spreading fashion among large companies to appoint CROs – Chief Risk Officers. This new office appears to have been created in response to the perceived failings of other Chiefs: Chief Financial Officers, Chief Compliance Officers and Chief Audit Executives. Collectively these predecessors in financial institutions failed spectacularly to prevent the recent sub-prime crunch – despite the demands and exhortations of Turnbull, the Basle Accords, Sarbanes Oxley, and an army of regulators. Will Chief Risk Officers fare any better?

All the previous Chiefs have been charged with reducing or preventing “accidents” – mostly in the form of non-compliance with the rules. In other words they move within the Perception>Behavior>Failure>Perception control loop. But who is in charge of the overall balancing act that has to be performed in pursuit of resilience? There appears to be growing agreement on CRO websites that their job should be to “manage risk within the organization’s risk appetite.” This sounds remarkably like the job of the Board and the CEO – whose twin responsibilities are the preservation of the company and maximizing shareholder value. So effectively the CEO becomes the CRO – Chief Resilience Officer.

We must avoid behaving like the anecdotal drunk who looks for his keys not where he dropped them but under the lamp post, because that is where there is light to see.

As with companies, so with all of us; the most resilient among us are those with the best sense of balance. Some choose to perform on a high wire where risk is greater but success is more generously rewarded; others prefer to stay closer to the ground where the rewards are more modest. There is no magic formula that can ensure success. We must – CEO/CRO and all the rest of us – avoid behaving like the anecdotal drunk who looks for his keys not where he dropped them but under the lamp post, because that is where there is light to see.

Let there be no illusions. Resilience is not calculable. Unquantifiable, disputable, and disputed, judgment will remain central to its pursuit.

RESUMÉ John Adams

John Adams is Emeritus Professor of Geography at University College London. Over the past 30 years his work on traffic and transport has led him to deal increasingly with the topic of risk, which has become a growing focus of his work. Among other honors, Adams has been elected an Honorary Member of the Institute of Risk Management and was awarded the Inaugural Roger Miller Essay Prize by the Association of Insurance and Risk Managers.

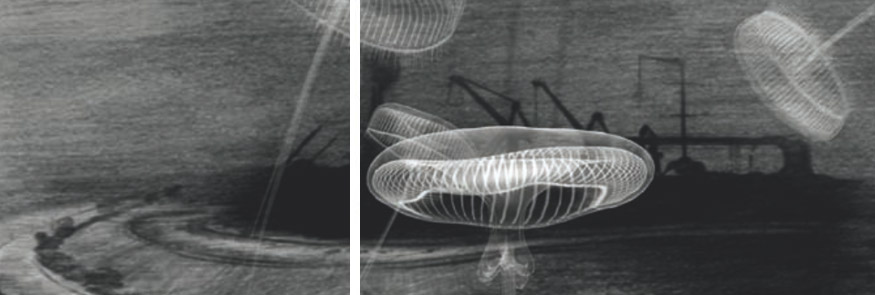

Illustration: Katja Davar, Shells on Mountain Tops (animation still), 2006, b/w, silent, 01:30 min