Egon Zehnder’s 2025 US Chemical Process Industries Forum brought together 80 senior leaders to discuss value creation across ownership structures. Board members, CEOs, CFOs and CTOs shared their perspectives, shedding light on the challenges and opportunities for value creation across ownership structures within the sector.

Many of those leaders took time to sit down with us and share where they see the industry is headed, as well as their thoughts on talent in the space. Bernard Scholl and Bertrand Paulet were met with several distinguished guests, including:

- Ilham Kadri, CEO of Syensqo

- John Buckley, President and CEO of Wilbur-Ellis

- Mike Doss, President and CEO of Graphic Packaging International

- Raj Gupta, Former Chairman and CEO of Rohm and Haas and Independent Board Director (multiple places)

- Scott Wolff, President and Director of American Securities

Panel Insights

Panel Insights

As we reflect on the conversations and insights shared during our evening in Philadelphia, we’d like to highlight several key takeaways we heard from our panelists: Raj Gupta, Former Chairman and CEO of Rohm and Haas and Independent Board Director (multiple places); Scott Wolff, President and Managing Director, American Securities; Mike Doss, President and CEO, Graphic Packaging; Marcello Boldrini, CEO, Kraton Corporation; and Hassan Rmaile, President and CEO, Multi-Color Corporation.

1. Defining and Measuring Value Creation (Across any Ownership Structure)

1. Defining and Measuring Value Creation (Across any Ownership Structure)

One panelist boiled it down to three essential ingredients whether the setting is public, private or PE: revenue growth, cash margin on sales and cash return on capital. “There are different ways to get the same results with different time horizons, but if you deliver on those three things, you will be successful.”

Outside of financial reporting, panelists called out metrics that may get overlooked. This includes a separate measure for employee engagement. “When you get happy people in the company, you have great customers. And then financials will happen- it’s just full circle.” Safety was also called out as another metric, especially in this industry. “It’s critical when our employees go home safe, but it’s also a sign of how we’re doing from an operational perspective...and a sign of value creation.”

2. Challenges and Opportunities- Communication is Key

2. Challenges and Opportunities- Communication is Key

Panelists reinforced how both public and private companies can create value, but they face different sets of challenges and require different strategies. They emphasized the need to ensure clear communication of long-term strategic vision and milestones even when making significant investments that may impact short-term results.

Public companies need to communicate effectively to avoid surprises and maintain investor trust. One panelist noted, “You can have a long-term view with a public company as long as you have clearly laid out what the milestones are, what to expect in the short term and are also willing to admit mistakes and know when it’s time to change course.” Another CEO added, “If suddenly you stumble, and you’ve got to recover quickly, you just have to embrace that.”

When it comes to getting buy-in on big opportunities, one CEO shared, “It’s not about reviewing hundreds of pages of data and financials since if you can’t explain it on one page, it’s probably not worth doing.”

3. Long- and Short-Term Decision Making – The Need for Speed (and Patience)

3. Long- and Short-Term Decision Making – The Need for Speed (and Patience)

Many of the panelists compared the speed of decision-making in private equity to public companies, noting that private equity moves faster due to a clear investment thesis and strategy. One CEO referenced, “It's like a horse race every quarter, but when you come to private equity, you realize you’re actually moving faster… but it’s a thoughtful speed, not crazy speed.” Another CEO explained how public company boards often have multiple layers of review, which can slow down decision-making whereas in other ownership models the board knows the business inside and out.

When it comes to long-term decision making, one CEO noted that private companies often have no exit strategy, saying, “Some people are motivated from an exit strategy….but on the other hand, you don’t have the same amount of near-term pressure because the shareholder may be thinking longer term about certain things.”

4. Secrets to Success in Leadership and Talent Development

4. Secrets to Success in Leadership and Talent Development

Panelists also shared perspectives on connecting the dots across enterprises to create better mapping for talent retention, succession and leadership training. One panelist emphasized the importance of regular talent reviews, not just at the CEO level but also two to three levels down where there are high potential people. “Get those people in front of the board and ask the following questions: Should we get them extra help? Do they have weaknesses? Should we give them an executive coach?”

Rotational assignments were another opportunity called out as a low risk but high reward way to build additional skills over time. “Some of the best business leaders I've seen zigzag in organizations. They didn't just stay in a single function all the way through and then parachute at the top.”

Another leader emphasized the importance of building cohesiveness, empowering and allowing the team to shine without becoming a bottleneck. “Give them an opportunity to connect directly with the top no matter the ownership structure. When you make sure you have a good alignment with your team, everybody at the end of the day is singing the same song, and the messages don't get conflicted.”

Pulse Check Insights

Pulse Check Insights

During the forum, we also sought the attendees’ opinions on the current state and future direction of the industry through a pulse check. The findings reveal a sector at a critical juncture—grappling with global uncertainties while seeking to innovate and generate value.

- Industry Challenges and Pressures: Geopolitical uncertainty and market volatility are the most pressing challenges, cited by 42% of attendees. This reflects the broader global instability affecting supply chains, energy markets, and investment flows. Declining market demand (21%) and a lack of return on innovation investments (12%) further underscore the financial and strategic pressures facing companies. Cost inflation (8%) and the need to enhance digital transformation (6%) were also noted, while a significant portion of respondents pointed to talent attraction, succession planning, and regulatory compliance as additional hurdles.

- Opportunities for Transformation: Despite these challenges, industry leaders see clear opportunities for transformation. The integration of digital technologies and Industry 4.0 was the most frequently cited opportunity (28%), suggesting a strong belief in the power of automation, data analytics, and smart manufacturing to drive efficiency and innovation. Market consolidation and the emergence of large, focused players (24%) were also seen as pivotal, alongside the push for green solutions and carbon neutrality (21%). Other opportunities include increased investment in U.S. industrial sectors, greater private equity activity, and expansion into emerging markets.

- Innovation and Performance Levers: Interestingly, while innovation is a priority, 90% of respondents indicated that their companies are not currently considering partnerships with venture capital to drive it. Instead, performance is being elevated through customer-centric strategies (30%) and investments in technology and innovation (27%). Leadership and team development (16%) and cost-focused internal operations (14%) also play key roles. A smaller segment emphasized decentralized management and organizational design as performance drivers.

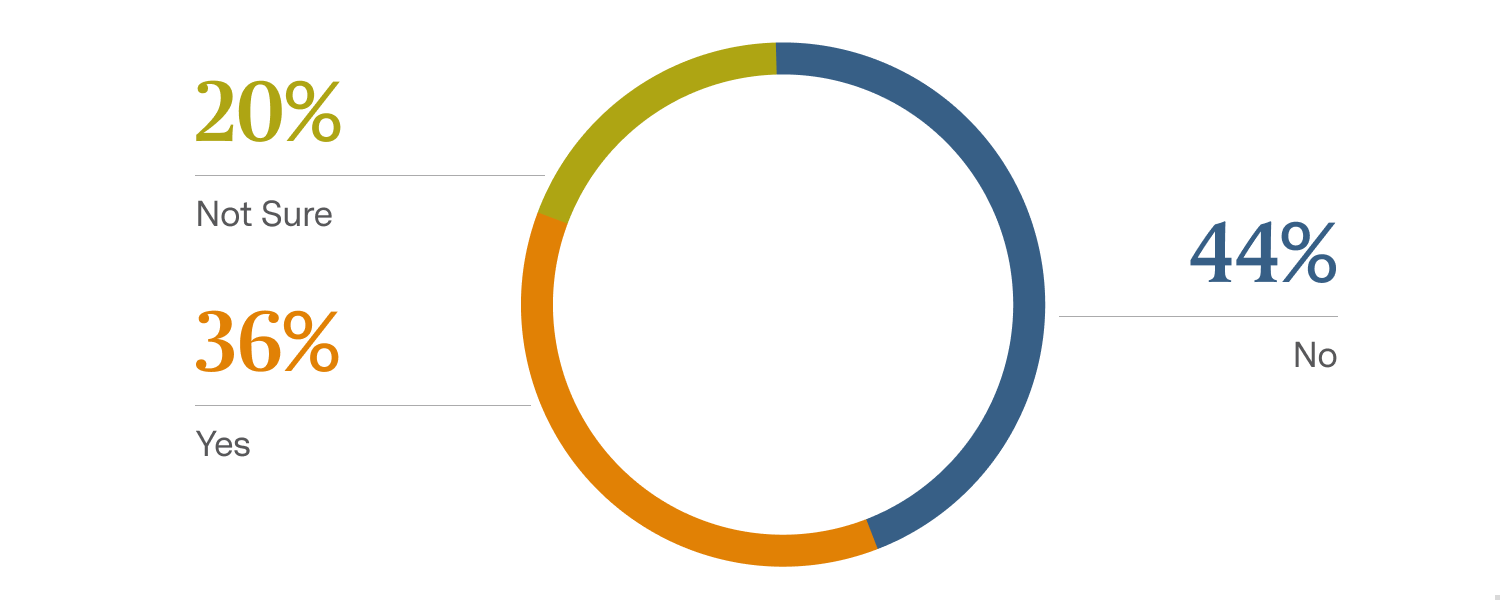

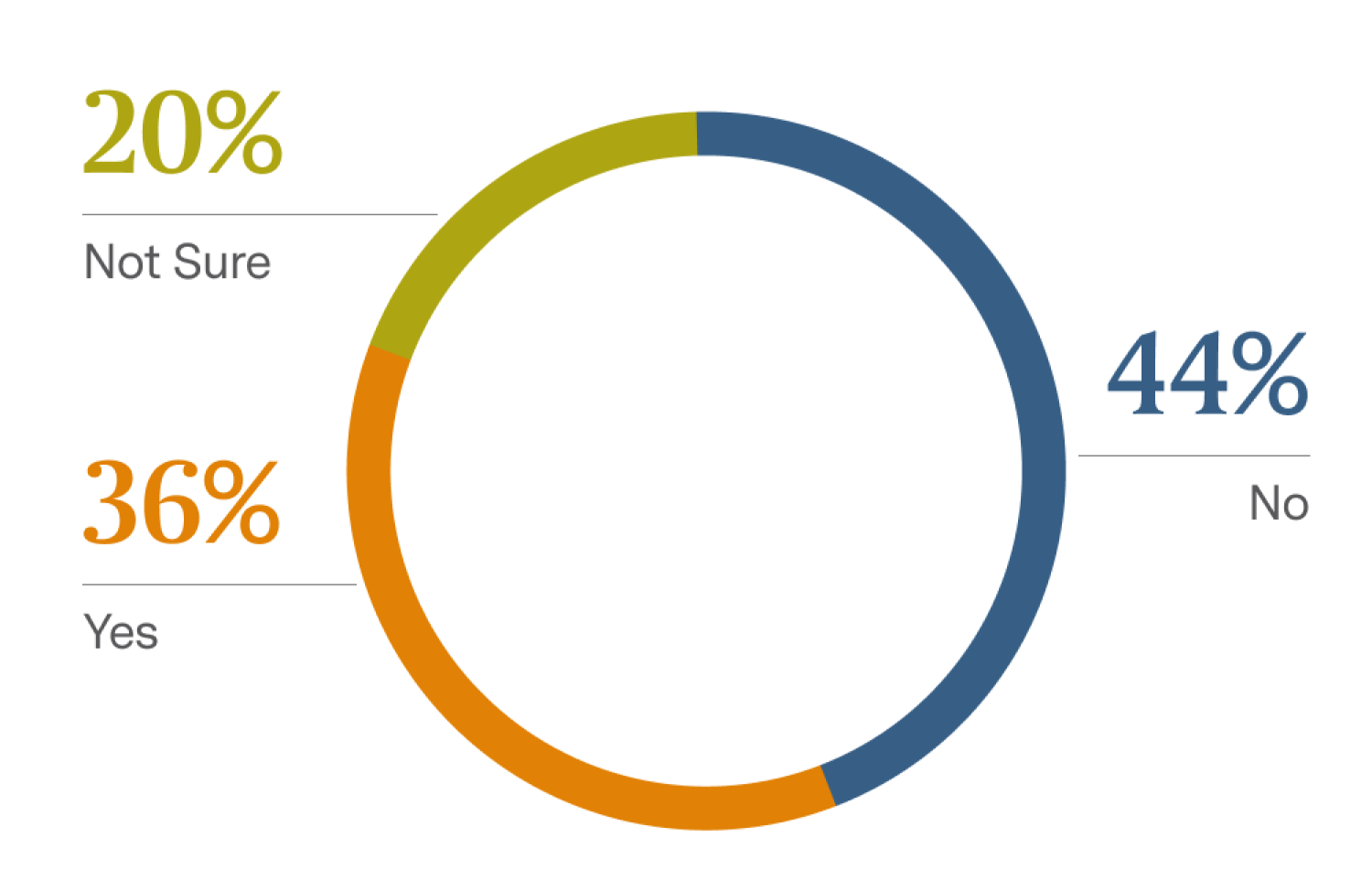

- Leadership and Talent Development: Leadership succession emerged as a critical concern. Only 36% of respondents believe their organizations have robust succession plans, and a striking 74% reported having no “ready-now” CEO successors. Most internal candidates are still two to five years away from being prepared for top leadership roles. This gap highlights a potential vulnerability in long-term strategic continuity. Attracting new talent also remains a challenge. The industry’s perception as outdated or lacking innovation was the top barrier (44%), followed by a general lack of awareness about its societal impact (23%). Competition with high-profile tech sectors (21%) and difficulties aligning with sustainability goals (12%) further complicate recruitment efforts. When hiring, a majority (59%) prioritize candidates with industry expertise, though a significant minority (36%) value external talent for the fresh perspectives and innovation they can bring.

Get In Touch

Get In Touch

Get in touch to join us at the 2026 Process Industries Forum: Don’t miss the opportunity to be part of the next wave of sustainability innovation.

Learn more about our Chemicals and Process Practice. Explore how our expertise can help your company navigate the complexities of sustainability and drive meaningful change.