Disruptive business models can come from any direction, and the types of risks the board must monitor have multiplied. At the same time, investors have become more demanding and more inclined to take action in the face of real or perceived underperformance. Boards now face both a higher bar and stiffer ramifications for failing to clear it.

In this environment, it is not enough for boards to oversee management—boards must monitor their own performance as well. To help them do this, boards often utilize board evaluations to get a sense of where they stand and how best to reinforce a culture of high performance in the boardroom. Undergoing a board evaluation every few years provides the board with an up-to-date snapshot of its strengths and weaknesses that can be easily fine-tuned. A board evaluation also can be helpful as part of boardroom milestone events, such as the appointment of a new board chair or CEO, involvement in a company transformation or a change in the composition of the board due to a merger.

It is important to note, however, that a board evaluation can vary greatly in its effectiveness. Based on our experience conducting more than 800 board evaluations for organizations in all sectors and regions, we have identified the following qualities that successful board evaluations have in common.

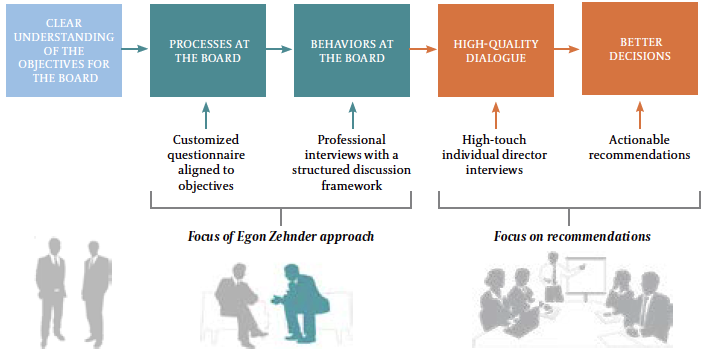

A board evaluation should be comprehensive. Board effectiveness is determined by two sets of factors:

- Processes, including agenda setting, board leadership structure and committee operations

- Behaviors, including competency gaps, quality of discussion and alignment with stakeholders

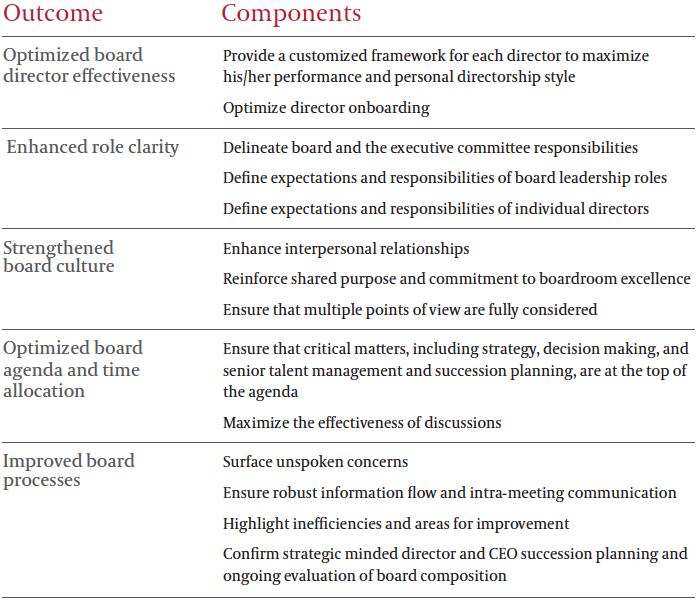

Many board evaluations focus on processes without probing behavior. This oversight is understandable, given that board governance is process-heavy. But a board’s performance is determined by more than its bylaws. The greatest insights often come from looking beyond guidelines—and evaluating how board members interact with each other and with their stakeholders. In addition to exploring the board’s processes and group behaviors, a board effectiveness review can examine how each member contributes to the board’s overall dynamic.These findings, along with practical suggestions for improvement, are shared orally and confidentially with the board chair and, if desired, with each director.

Boards face both a higher bar and stiffer ramifications for failing to clear it.

A board evaluation should combine both an online questionnaire and individual director interviews. How information is gathered greatly affects the quality of the assessment. Some boards attempt to conduct an assessment using only a questionnaire. We have found, however, that while a questionnaire is time efficient, by itself it frequently misses the nuances and telling details that are necessary to understand the board’s inner workings and fails to identify the obstacles that impede high performance.

A better option is for the questionnaire to be used for framing the major issues facing the board and then follow up the questionnaire with structured individual interviews that allow for a deeper exploration of key topics.

A board evaluation should be conducted by an independent third party. Just as boards rely on law and accounting firms for objective and independent advice on legal and financial issues, a third party may be in the best position to provide counsel on board performance. Some boards conduct an evaluation internally, believing that this fosters the candidness necessary for a forthright discussion of sensitive issues. However, in practice, the opposite is often true. After all, the three members most likely to conduct an internal evaluation—the board chair, the nominating and governance committee chair, and the lead director—are themselves part of the interpersonal dynamic the evaluation seeks to understand. Even with the best of intentions, there is a limit as to how objective these individuals can be and how much candor they can expect.

Third-party board assessment specialists, on the other hand, are objective outsiders and are well versed in handling sensitive issues. They also bring two distinct advantages: First, board assessment specialists are trained in behavioral interview techniques that enable them to probe the specific factors defining board dynamics, such as the tenor of board deliberation and the way dissenting views are addressed. Second, because of their exposure to the inner workings of so many different boards, these specialists are in a better position to recommend best practices, warn against common pitfalls and offer proven solutions to challenges.

Many board evaluations focus on processes without probing behavior.

A board evaluation should result in concrete insights. A thorough board evaluation should assess the board across the full range of its responsibilities, providing specific suggestions by which the board can address key issues.

In addition to providing a road map for strengthening board performance, a board evaluation can be an important element in the board’s succession planning, identifying specific qualities and experiences that should be added as directors rotate off the board.

Board assessment specialists are trained in behavioral interview techniques that enable them to probe the specific factors defining board dynamics.

A board evaluation should be a positive, reinvigorating experience. The ever-increasing scope of board responsibilities means that a board rarely has the opportunity to reflect upon itself as a team and consider the group’s needs and performance. A board evaluation puts the board itself on the agenda. The chance to speak with informed listeners in a confidential environment commonly uncovers subtle or inadvertent ways in which the board may be undermining its own performance. These discoveries—and the confidence that comes from knowing that issues have been identified and can be addressed—leave board members with a renewed commitment to excellent corporate governance, greater group cohesion and a shared vision of purpose.