Even the most enterprising family businesses that deeply prioritize family capital management can find themselves making sub-optimal allocation decisions.

Why?

Blind spots.

Limited visibility into the full scope of their shared assets and a lack of strategic planning often lead to gaps, which can result in decisions that drift away from the family’s overarching purpose and long-term objectives.

Think back to what the early days of your family business may have been like for your founder. o. For many founders, managing shared family capital was straightforward because the majority of wealth was tied to a single enterprise. With a clear focus and direct oversight, decisions could be made efficiently, and aligned with the family’s mission and values.

But as businesses diversify, wealth grows, and family needs evolve, maintaining a cohesive view of shared assets becomes increasingly challenging. Without a holistic approach, families risk losing the alignment that binds their financial management to their core values.

In this article, we’ll discuss a variety of family capital management strategies, why having a strategy is important, and how you can set your company up for success long term.

Why is Family Business Financial Management Important?

Family business financial management is critical for ensuring the efficient use of shared capital, maintaining harmony across the enterprise, and securing long-term sustainability. Without a clear, cohesive strategy, families risk inefficient decision-making, misaligned goals, and even conflict that can erode both financial and relational value.

Here’s why a holistic approach to managing family capital is essential:

Optimizing Shared Family Capital

When entities within a family enterprise – such as operating businesses, family offices, or investment portfolios – aren’t communicating or accessing shared information, capital allocation becomes fragmented. This lack of coordination leads to inefficiencies and missed opportunities.

To maximize the value of shared capital, seamless communication between all parts of the enterprise is necessary. A family charter that clearly outlines agreements and guidelines that span the business, including family capital, can help support this. Integrated financial planning that brings together business leaders, family offices, and external advisors also fosters collaboration, ensuring decisions align with the family’s overarching mission and financial goals.

Succession Planning Beyond the Operating Business

Succession planning isn’t just about deciding who will lead the family business; it’s about managing the enterprise at a strategic level. Families often focus on leadership succession within the company while overlooking the need for enterprise-wide planning. A holistic financial management strategy provides enterprise-level oversight of assets across all institutions, from the operating company to shared family properties, philanthropic foundations, and investment portfolios.

It also defines roles and responsibilities for individuals managing these assets and ensures strategic planning for funding cash needs, such as estate planning, shared properties, and charitable initiatives. This level of planning prevents value destruction, mitigates conflict, and ensures the family enterprise thrives across generations.

Protecting Against Value Destruction and Conflict

Without a unified strategy, families risk making decisions that are misaligned with their long-term values and financial goals. This misalignment can lead to duplicative efforts or inefficient capital deployment across different entities. It can also create confusion over financial responsibilities, particularly when managing shared assets or funding collective initiatives, and lead to potential conflicts between family members or institutions due to unclear roles and inconsistent decision-making. A clear and cohesive financial management framework addresses these risks, providing clarity and alignment for all stakeholders.

What is the Goal of Family Business Financial Management?

When a company is founded, it’s usually with intention and motive that family members can rally around. Revisit this intention and see how it might have changed based on what the family now hopes to achieve through their shared assets and how they use their capital, and then redefine it, if necessary.

The purpose you define should go beyond a mission statement. It should stem from collective contribution, be unique and meaningful, authentic and relevant and filled with intention that cultivates action.

Of course, this is easier said than done. With many individuals making up a family, it can be difficult to find a collective purpose, but without it, harmony is lost. To help ensure all individuals are included, engage the members of your family to uncover what makes you all unique and united. Remember that your purpose may change as your enterprise grows and evolves across generations. It’s good practice to return to this at regular intervals.

With purpose in hand, you can engage all individuals, align diverse interests and make even stronger capital allocation decisions.

Family Business Financial Management Framework

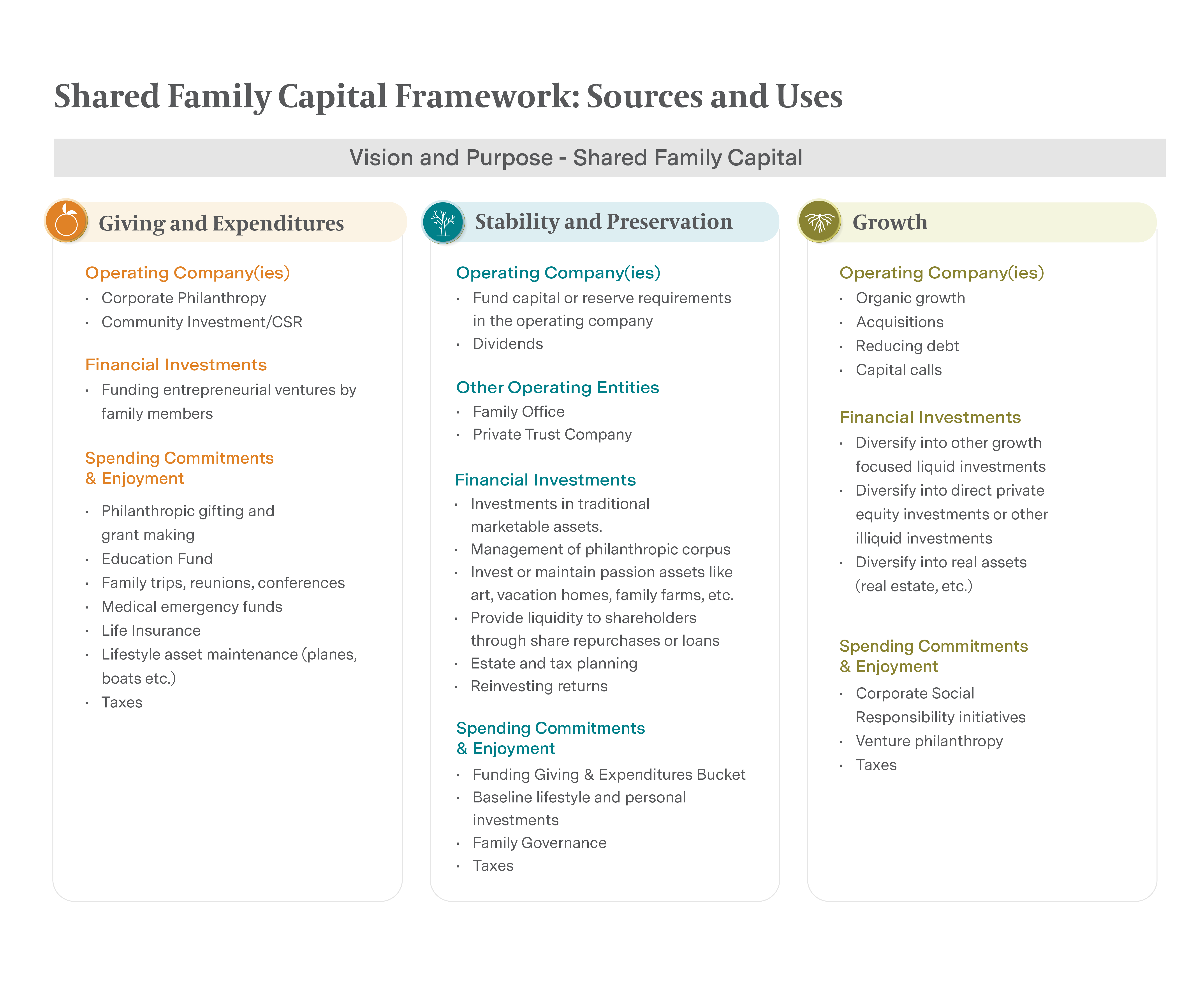

Before optimizing your family’s shared assets holistically, it’s essential to take inventory of what those assets are. A comprehensive understanding of your family capital is the foundation of effective financial management. This process often requires collaboration and multiple iterations, as families may not have a complete picture of all assets. Frequently, these assets are spread across different structures, managed by various individuals, or even held in separate locations.

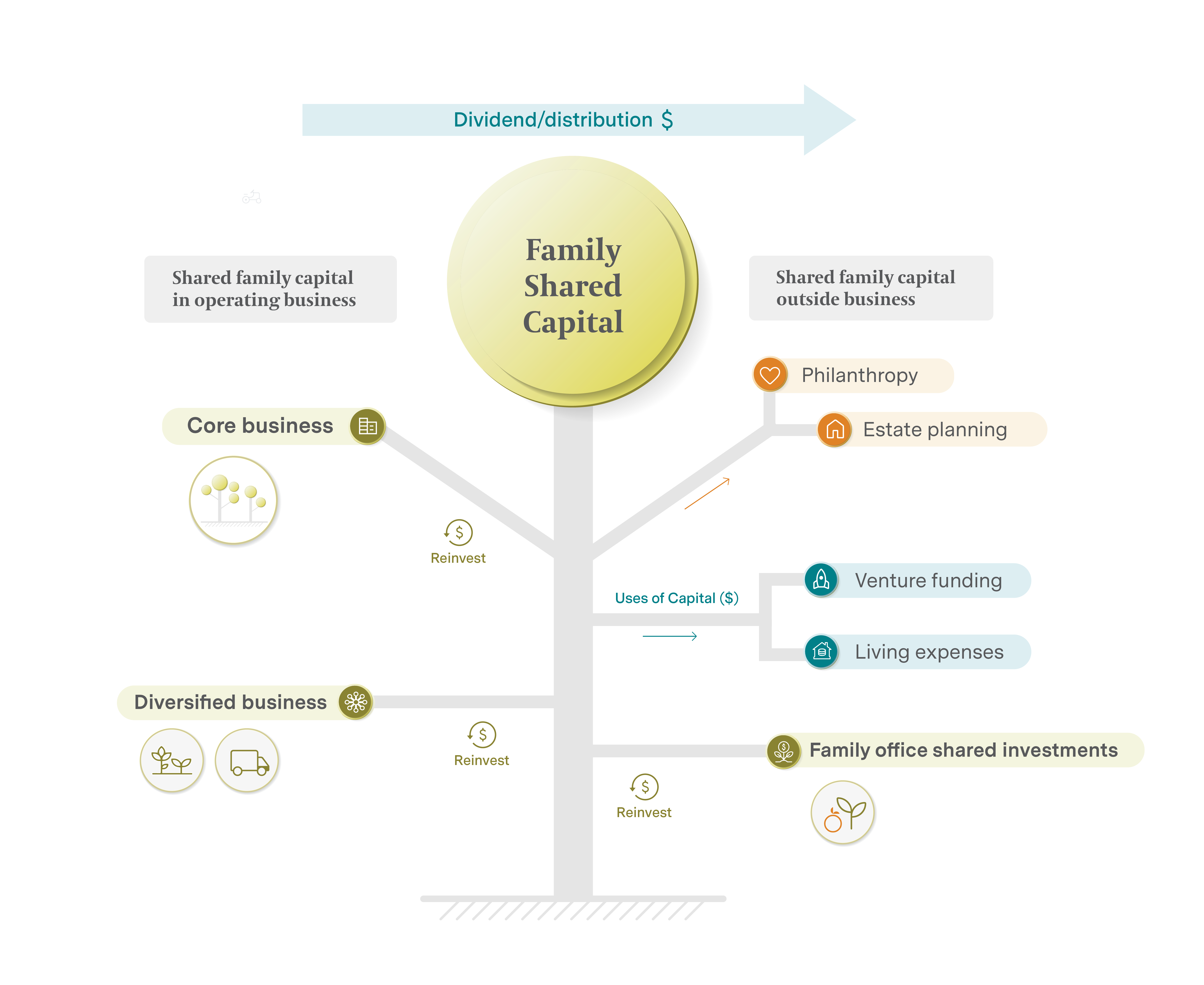

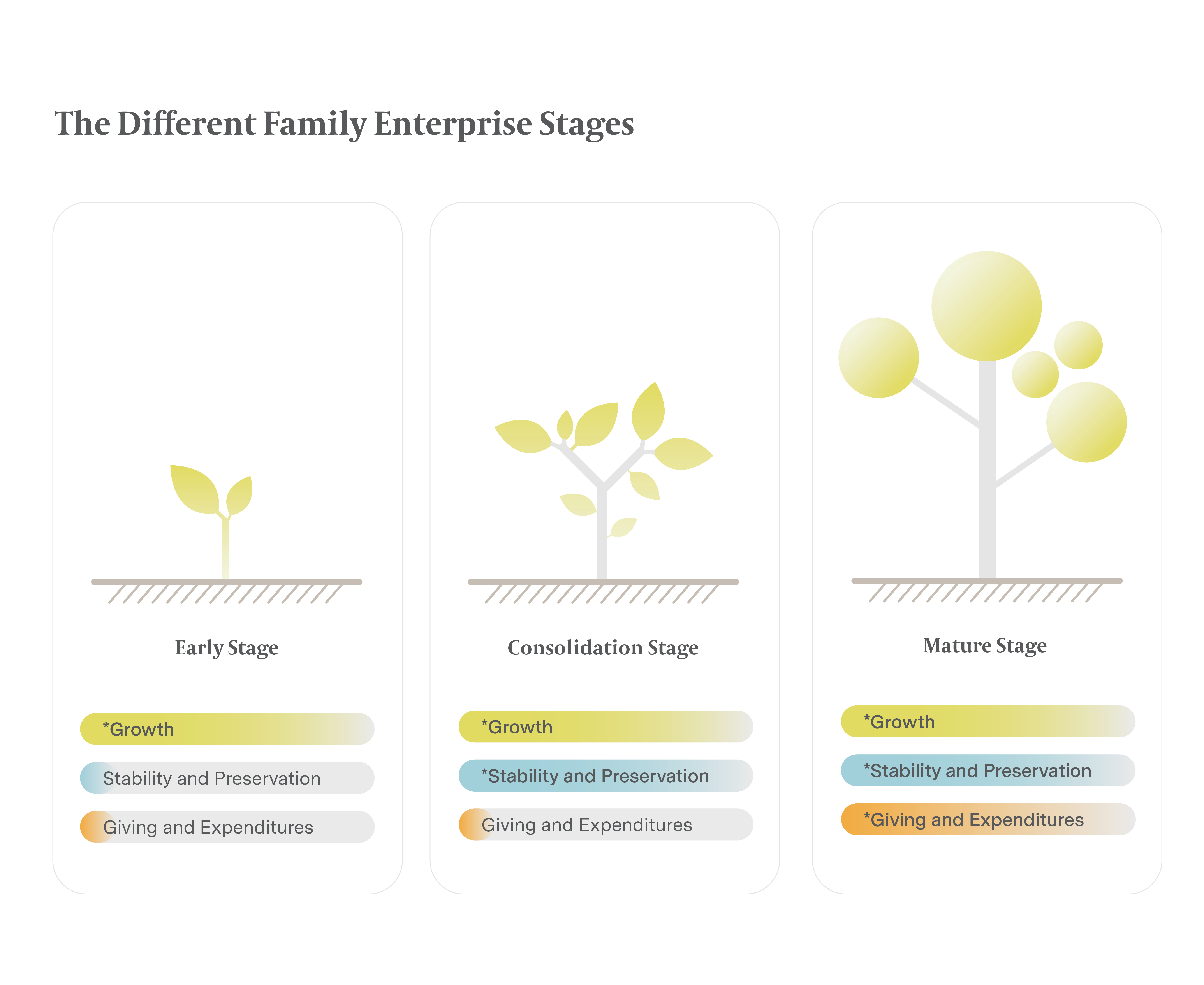

To make this process clearer, think of your family enterprise’s diversified assets as part of a tree, with three main categories (or “buckets”) representing your shared family capital. Identifying and organizing these assets is key to developing a financial strategy that aligns with the family’s goals and values.

Why a Comprehensive View of Family Capital Management is Crucial

Maintaining a broad perspective is vital, even if your family’s assets seem simple and manageable today. Growthand diversification naturally bring complexity, and decisions that once seemed straightforward can quickly become intricate. Additionally, every asset can serve as both a source and a use of capital, depending on the family’s needs and priorities.

For instance, consider funds set aside for philanthropy (a use of capital). In an economic downturn, those funds could be reallocated to support the operating company, such as covering payroll, transforming them into a temporary source of capital. This adaptability underscores the importance of having a clear, all-encompassing framework to manage your family’s financial resources effectively.

Aligning Family Capital Management with Values

While the buckets of capital may correlate to different stages in the company’s maturity, it’s crucial to think of them as independent of the company’s growth phases. Families make values-driven decisions at every stage of their enterprise. For example, some families prioritize charitable giving early in their business journey, while others may focus on reinvesting profits to drive growth. The key is to understand the sources and uses of capital and strategically plan how to allocate assets now and in the future.

By maintaining a holistic perspective, families can optimize decision-making, strengthen unity, and ensure their assets align with their shared purpose. This forward-thinking approach positions the family enterprise for sustainable growth and resilience across generations.

Avoiding Common Pitfalls in Family Capital Management

Growing and sustaining varied assets can be overwhelming. Many family business leaders struggle because they lack a complete picture of their financial landscape. Others make decisions with a limited mindset, focusing solely on current assets rather than considering how those assets could evolve to meet future goals. This narrow view can hinder the family’s ability to achieve its shared mission or adapt to changing circumstances.

An all-encompassing framework helps mitigate these risks by:

- Providing clarity on all assets and their roles within the family enterprise.

- Promoting unity by aligning financial decisions with family values.

- Preparing the family to navigate future complexities and opportunities.

Take the Next Step in Assessing Your Shared Family Capital Management Strategy

What are the fruits of your family’s labor? Use this framework to assess and organize your shared family capital effectively. A detailed understanding of your assets will allow your family to build a financial management strategy that not only preserves wealth but also fosters alignment with your values and long-term goals.

Why a Family Business Financial Framework Matters

A robust financial framework is essential for family businesses to effectively manage and optimize shared capital. It fosters organization, encourages family harmony, and prepares the enterprise for future challenges and opportunities.

Here’s a closer look at the key reasons why having such a framework is critical:

Organization and Optimization

A well-structured financial framework provides clear visibility into your family’s complete inventory of shared assets. By consolidating income sources and aligning capital allocation strategies, families can manage their resources more effectively. This clarity ensures that shared family capital is not only preserved but also optimized for growth and strategic use. With an accurate and comprehensive view of all assets, families can identify inefficiencies, streamline operations, and make informed decisions that maximize the value of their financial resources.

Promoting Family Harmony

Financial alignment plays a pivotal role in maintaining family harmony. A shared framework ensures that capital is allocated in alignment with the family’s collective purpose, fostering transparency and trust. By encouraging open discourse around the use of shared assets, the framework helps address any misalignment through appropriate policies and governance.

Moreover, it allows for the possibility of individual strategies, enabling family members to pursue their own ventures without feeling constrained by the larger family enterprise. This balance between shared goals and individual autonomy strengthens relationships and prevents conflicts.

Future-Proofing the Enterprise

A family business financial framework prepares the enterprise for unforeseen circumstances and emerging opportunities. With a clear understanding of options and the lowest-cost alternatives for accessing emergency capital, families can navigate crises with confidence. Additionally, the framework supports long-term decision-making, ensuring shared assets are managed sustainably to meet evolving generational needs and preferences.

As the family grows and diversifies, a flexible financial framework enables the enterprise to adapt its capital allocation strategies to support new goals and priorities. This forward-looking approach ensures resilience and relevance in a constantly changing landscape.

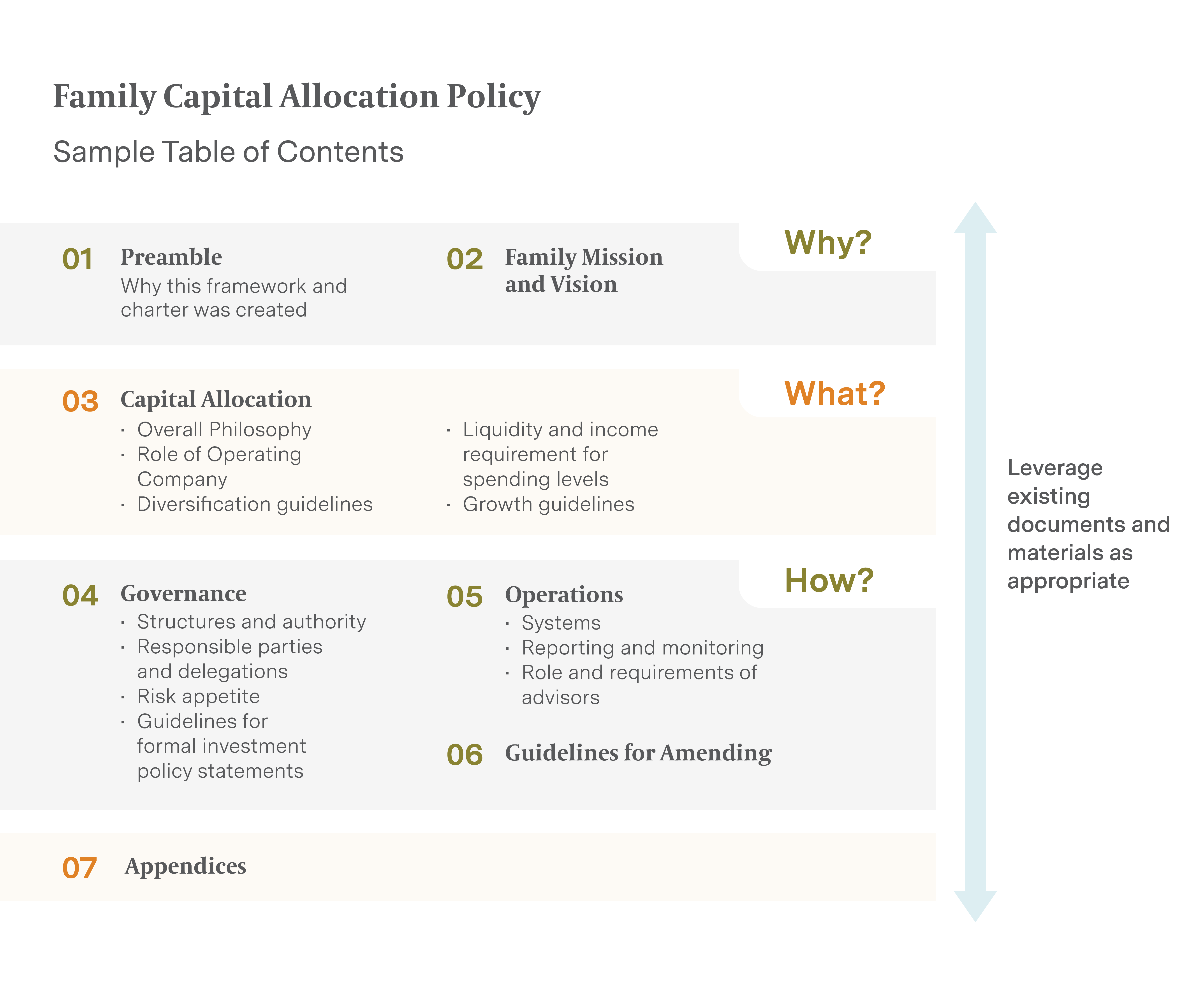

Family Capital Allocation Policy Example

A well-defined Family Capital Allocation Policy serves as a roadmap for managing and growing shared family wealth. By establishing clear guidelines around your family’s mission, governance, and capital allocation strategies, this policy provides a unified framework to align financial decisions with the family’s values and long-term goals.

The table of contents below offers a structured approach, answering the key questions of Why, What, and How family capital should be managed. From articulating your family’s mission to outlining governance structures and operational systems, this policy ensures that every aspect of your shared capital is thoughtfully considered. By leveraging existing documents and tailoring this framework to your unique needs, families can create a comprehensive plan to preserve and grow their wealth for generations to come.

Let’s dive into each section to explore how this framework helps unify decision-making, enhance financial visibility, and promote harmony across the family enterprise.

Family Business Financial Planning Case Study

It helps to see it all in action. The following case study serves as a real-world example of the applications of this framework:

A well-established, highly successful family company had a vision to sustain business for years to come, but even though the company was in the mature stage of development, a disproportionate amount of focus was still being spent on the operating company. Instead, the family ownership group needed to allot attention toward family decision-making related to establishing a strategy to support stability and preservation for the operating company and the current family wealth while establishing a foundation for future growth.

This assessment wasn’t just made overnight. The issue came to surface after an owner leading the operating company, the CEO, noted that the business maintained significant cash reserves, well beyond what they envisioned needing. This begged the question: could cash reserves be more effectively deployed? This starting point led to a larger discussion about how capital was allocated across the enterprise.

Beginning with a bottom-up approach, the family, in collaboration with the operating company management team, first assessed and agreed upon the capital and reserve requirements of the operating business. “Paying the business first” ensured that the family protected the very foundation of their shared family capital.

They then analyzed how excess capital could be effectively allocated/invested for the benefit of the family, including future opportunities for the operating company and potential business ventures balancing the concurrent objectives of maintaining a defined level of wealth while pursuing opportunities for growth.

Lastly, they worked their way up to the top of the tree, where they assessed spending and lifestyle commitments of family members to see how these might be affected if changes were implemented. (This can be a difficult step, as each family unit is composed of individuals with different lifestyle expectations. Some are spenders. Some are more frugal. Families need to return to their purpose and decide what the business objective of funding the family might be.)

After these assessments, goals and priorities were defined and agreed upon. The resulting strategy prioritizes the health and competitive positioning of the primary operating company and preserves an agreed-upon standard of wealth for current and future family members through a diversified shared investment approach.

Family Business Financial Planning Results

Implementing a financial framework for family business planning yields tangible results, fostering organization, harmony, and long-term sustainability. By taking a strategic approach, families can create policies and structures that align with their shared goals while allowing for individual flexibility. The above example demonstrated how one family used a comprehensive framework to optimize their financial management, promote collaboration, and prepare for the future.

To make these policy changes, this family stuck to the framework. They returned back to basics, assessed and strategized to invest in their long-term sustainability and success for generations to come.

It’s important to note that framework or not, these changes would not have been made had it not been for the concerns raised by the CEO. Because this family was close-knit and had strong communication, a family member was able to implement changes, but sometimes an outside advisor is helpful.

Even though this family worked well together, they still held disparate viewpoints. The new policy solved for these by putting together an approach that everyone could agree upon. For example, the policy that is now in place gives individuals an exit strategy if their needs and priorities don’t align with the shared capital strategy. This gave everyone the comfort they needed to move forward unanimously.

9 Best Practices for Family Business Financial Management

Effectively managing family business finances requires a combination of thoughtful planning, clear communication, and structured processes.

As family enterprises grow in complexity, it becomes essential to adopt practices that ensure alignment across members, optimize capital allocation, and prepare for long-term sustainability. The following best practices provide a roadmap for creating a robust financial management framework tailored to the unique needs of your family business.

Whether you’re addressing governance structures, access to data, or flexibility for future challenges, these principles will help you navigate the intricacies of managing shared family wealth with confidence and clarity.

Here are the best practices we’ve developed from years of experience in the field:

1. A Framework that Fits

Does your business require a low- or high-complexity infrastructure?

Larger family enterprises that have been in business for many years and have an intricate tree of assets require a more sophisticated infrastructure to support them, while smaller enterprises require a simpler frame to build from. No matter if low or high, as long as an effective infrastructure is in place, businesses can scale up proactively as complexity grows.

2. Family Commitment to the Process

It’s critical that your entire family understands the value of a holistic view and appreciates the need for family clarity on the purpose of their wealth. This can be achieved through group work to define purpose, processes, and roles, and through consistent transparent reports throughout the process.

3. A Leader of the Charge

The family CEO in the case study served as the individual who raised concerns and helped make plans for change, but for some families, this will not be the case. If not a CEO, family board chair, or patriarch/matriarch, an outside advisor or non-family member who is independent of the personal and emotional considerations of family members has many advantages. In other cases, a group of family owners may identify the need for change through a family council or regular family meetings.

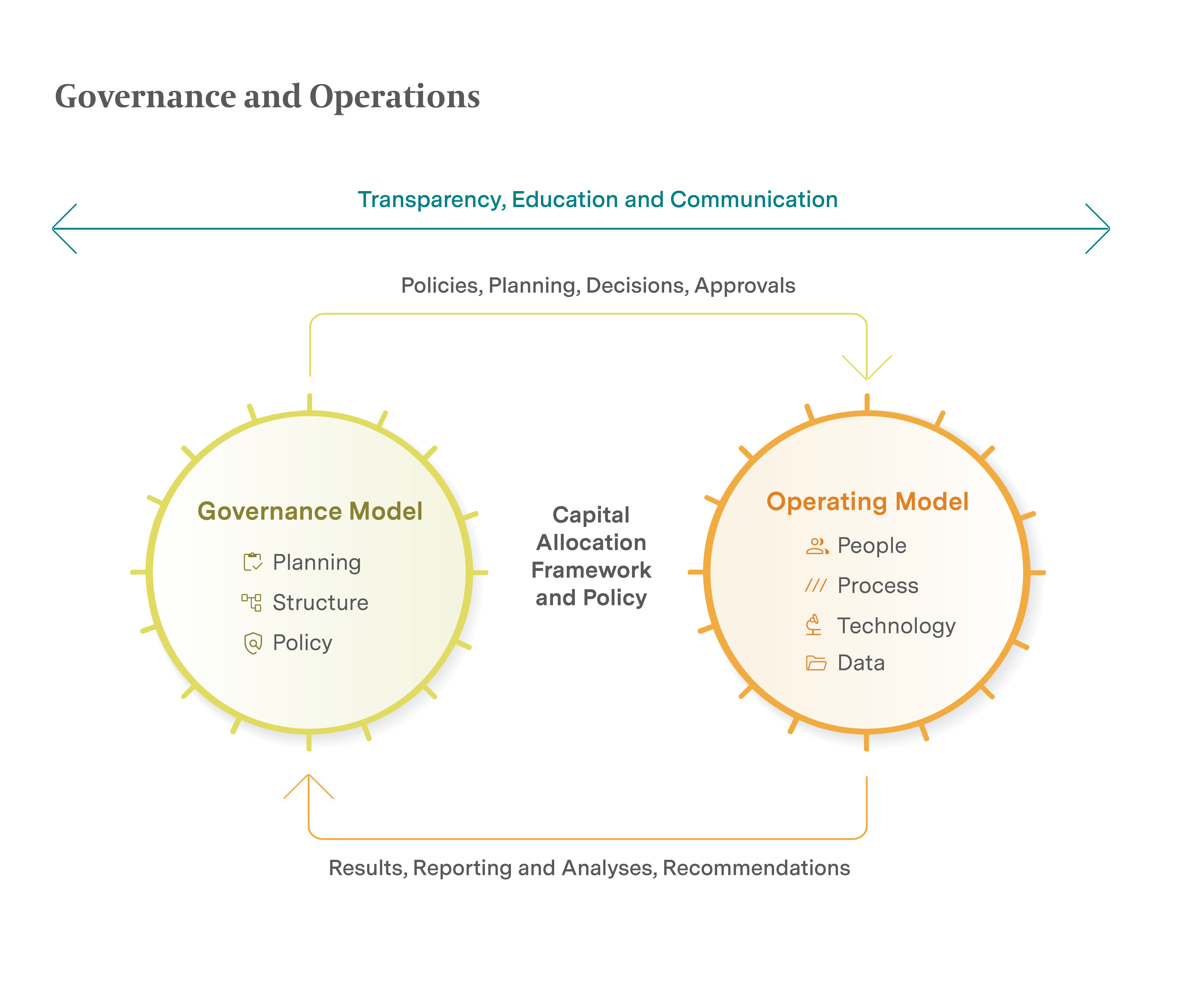

4. Governance and Operating Models

It’s important to have a structured governance model for the organization and oversight of your family policy.

The governance model should designate decision-making authority and roles and responsibilities of all other members in a standard Responsible, Accountable, Consulted and Informed (RACI) structure. Similarly, best practices include the implementation of an operations model for the actual execution and monitoring of your policy. This includes the people involved, the process, including risk management and reporting, as well as technology capabilities and the data sources, validation and security.

5. Decision-making Authority

There should be an enterprise-wide oversight entity for your shared family capital. Some entrust this in an individual (family or non-family), holding company board or owners committee, family office, or trustee (family trust company).

In addition, each operating business unit or family office within an enterprise may have its own governance entity responsible for implementing its own strategy. There is not a one-size-fits-all solution. It depends on the needs of your family. No matter who takes on the job, roles and responsibilities must be defined. Clarifying will help manage people’s expectations and keep the process on track.

6. Access to Data

Disparate sets of data housed in operating companies, investment portfolios, and/or entities holding real estate or other illiquid investments need to be looked at holistically, too, to avoid inconsistencies and manage consolidated risk exposures.

While some families elect to use their financial advisors or custodian to aggregate data, other more complex family enterprises may require a specific technology solution and in-house expertise.

7. Monitoring and Measuring

After a strategy is implemented, operations experts and technology are required to monitor and report back on relevant data. In more complex structures, a chief investment officer is useful for overseeing asset allocation and portfolio risk management, while a chief financial officer can help manage cash flow and finances.

There are many cloud-based technologies that can operate in-house or can be outsourced to deliver KPIs and KRIs in an easily digestible format. An example is an allocation dashboard, which includes a visual representation of investment, operating, and individual assets. Here you can view target, actuals and near-term forecasts of assets, and add exposures to tailor your strategy.

8. Flexibility

The world is ever-changing and uncertain, so your family’s policy should be built to be flexible and resilient. You can do this by leaving some capital available in the event of unforeseen issues, such as investment opportunities or to shore up at-risk operations.

9. Time and Dedication

Real, effective change takes time. The family from the case study achieved such successful results by returning to their shared purpose and deciding it was worth it to dedicate time and energy into their future success. And they took the time to gain the input of each family member to ensure individual interests were considered.

In their case, it took a year and many iterations to see these results, but every family enterprise has different needs.

There is no one-size-fits-all solution, and each family enterprise that employs this framework and approach can tailor their direction based on their unique needs. But no matter the path taken, the end result of a holistic perspective has both strong family value and business value. It has the power to create harmony and unite a family with a shared purpose, and the ability to enable more comprehensive, long-term decision-making and asset management for generations to come.

Take the Next Step Toward Financial Harmony and Long-Term Success

Family business financial management isn’t just about preserving wealth; it’s about aligning your financial strategy with your family’s shared purpose, values, and goals. A well-defined framework can drive better decision-making, foster unity, and create lasting value for generations to come. Whether you’re navigating complex governance structures, planning for succession, or managing diverse assets, having a strategic partner can make all the difference.

At Egon Zehnder, we specialize in guiding family businesses toward sustainable success through tailored financial strategies and expert advisory services. With decades of experience in family capital management, we understand the unique challenges and opportunities that come with managing shared wealth. Let us help you craft a holistic financial strategy that ensures harmony today and secures your legacy for the future.