It’s not uncommon for organizations across industries to face a growing problem: a complete lack of alignment between the company strategy and its incentives. Each function defines success differently. Sales focuses on revenue, operations on efficiency, customer service on satisfaction, finance on cost. Teams are swimming in their own KPIs, and no one sees the full picture.

In some companies, this fragmentation has gotten so extreme that entire teams have been created just to track and reconcile performance data for yearly bonuses. This invites the reflection: Is the cost of complexity worth the while?

We’ve seen examples where employees each had 8 to 10 personal KPIs—many of them self-defined—and HR was buried for months calculating payouts. The result? Complexity, misalignment, and fatigue, with little impact on business performance.

To be effective, incentives require thoughtful design and understanding key tradeoffs. This is where short-term incentive plans (STIPs) come in. Not as a quick fix, but as a structured way to align teams, reinforce strategy, and bring clarity to performance expectations. While STIPs cannot be considered the ultimate solution to address these challenges, they serve as a powerful method to convey the organization’s short-term priorities.

Every STIP Is a Balancing Act: 6 Key Elements to Consider

Every STIP Is a Balancing Act: 6 Key Elements to Consider

In our extensive work with clients and in-depth conversations with CHROs, we've identified six core design elements that sit at the heart of every short-term incentive plan. These aren’t simple checkboxes to tick—they’re deliberate choices that reflect an organization’s philosophy, priorities, and expectations for how people contribute to success.

1. Strategy and philosophy

1. Strategy and philosophy

At the core of any STIP, it is critical to establish clear objectives that align with the company’s culture and strategy. Helpful questions to ask include, “What are we trying to reward? Collective achievement and strategic alignment, or personal contribution and differentiated performance?”

Some companies design plans that reflect shared success—company-wide goals, culture-building, strategic milestones. Others lean toward competitive, individual metrics. Both approaches have merit. The key is to make a conscious choice based on your strategy and culture. Taking the time to reflect on the objectives of incentive plans is well worth the effort of the whole plan.

2. Calculation model

2. Calculation model

The calculation model impacts the weighting assigned to different factors (results, client satisfaction, safety, etc.) and whether it is at the company level or at the area/individual level.

To formulate the optimal model for your organization, consider this: Formulaic models provide transparency and consistency—they can feel unfair in volatile environments, where external forces drive outcomes more than effort. Discretionary models allow for nuance—recognizing effort, leadership, or role modeling—but require trust in managers and clear guidelines to avoid bias. These are all weighty considerations to make.

3. KPI structure

3. KPI structure

The KPI structure is the quantitative and qualitative indicators that are used to measure the performance of business and support areas. STIPs rely on KPIs to guide behavior.

This component is critical when it comes to calculating payouts—we’ve seen companies move from 1–2 global KPIs to dozens of personalized ones, only to spend months in their calculations. A strong STIP keeps KPIs focused, strategically aligned, and clearly linked to performance levers that employees can actually influence.

4. Individual performance differentiation

4. Individual performance differentiation

Many companies struggle with how to reward high performers versus average ones. This is why this tool can be used to differentiate the incentives for those with high and low performances.

Flat payout curves are easier to administer and feel less controversial—but they undercut the motivational impact of incentives and do not provide opportunities for individual performance conversations. Differentiated payout structures require more robust performance management and calibration but send a clear message about standards and excellence. They again require trust in management, particularly on their ability to do a fair evaluation of talent and value added over the last period of time. A STIP should have room to reflect varying levels of contribution. Otherwise, it risks becoming an entitlement rather than a reward.

5. Funding mechanism

5. Funding mechanism

Where does the money come from? Some companies link incentive pools to metrics like EBITDA, revenue, or tickets closed—tying payouts to overall business health. Others budget a fixed bonus amount and distribute it regardless of performance. The former creates accountability and discipline but can frustrate employees in years where effort was high but financial results fell short. The latter offers stability but can feel disconnected from business outcomes. Design a model that aligns with how your company manages performance and risk.

6. Boundary conditions

6. Boundary conditions

Many organizations can pose limits to ensure bonuses stay within acceptable ranges. These controls can protect against excessive payouts or minimum payouts in underperforming years, but they can also limit flexibility in rewarding exceptional contributions. It is common to find companies that set borders (lower or upper) that determine the payment of the incentive. What’s important is defining clear boundaries—and communicating them early.

The Four Tradeoffs Leaders Should Consider

The Four Tradeoffs Leaders Should Consider

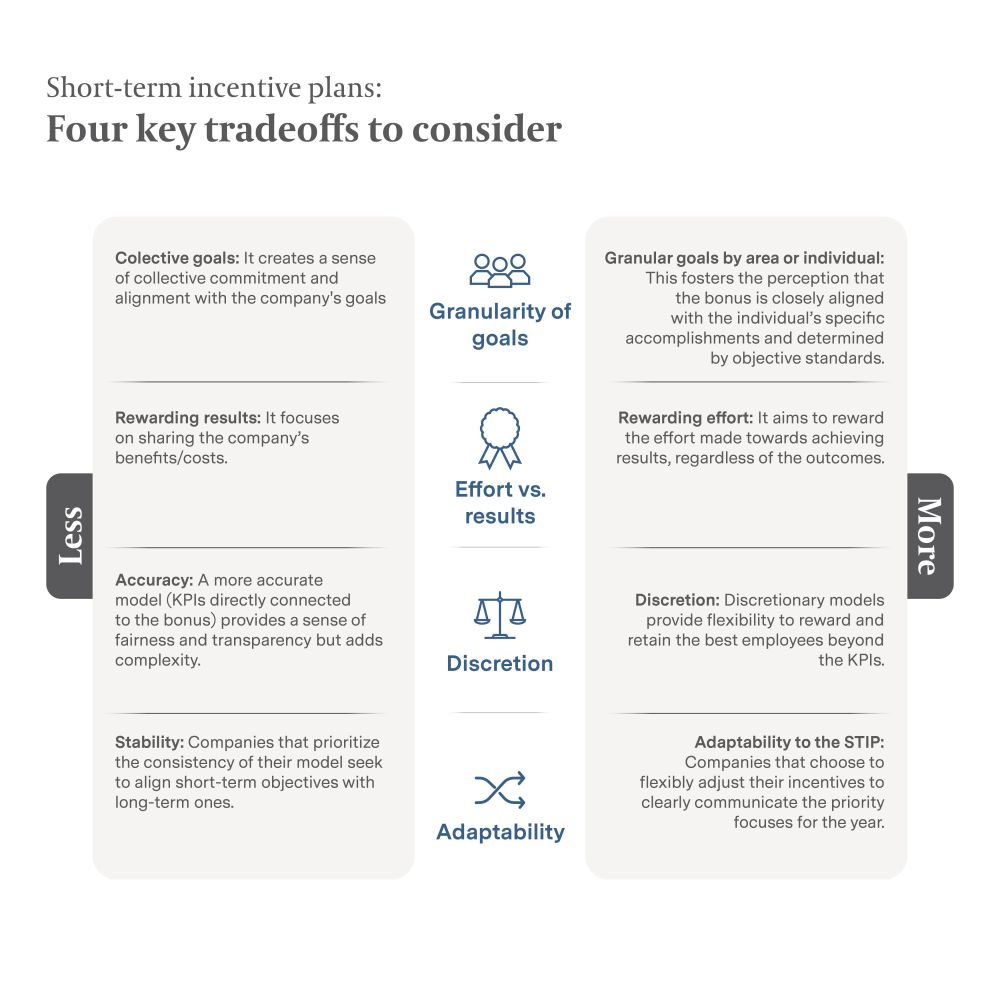

As the leadership team works together to take definitions on these foundational elements, leaders must confront a series of critical tradeoffs. These decisions aren't just details—they will make or break the effectiveness of the STIP. Here are four to weigh carefully:

1. Granularity of goals:

1. Granularity of goals:

Do you want collective, company-wide objectives that create shared focus and alignment? Or should goals be tailored by function or individual, giving people a clearer sense of personal impact?

Example: In the mining sector, one multinational company—seeking to foster a unified, “one-firm” culture—chose to prioritize broad corporate goals applied uniformly across all subsidiaries and assets. This approach emphasized collaboration, alignment, and organizational clarity. In contrast, another mining firm took a more granular route, setting detailed targets by business unit, asset, and even individual level. This allowed them to better recognize and reward the distinct contributions of each team and employee.

2. Effort vs. results:

2. Effort vs. results:

Some organizations reward measurable outcomes—linking incentives directly to business success. Others prioritize effort, recognizing employees who contribute meaningfully considering that results might be out of their control.

Example: A retail company structured its incentive system around centrally defined corporate and departmental goals, with HR playing a key coordination role. Bonuses reflect alignment with these priorities and recognize both group and individual contributions, while financial results have a relatively small impact on payouts. In contrast, a mining company follows a more results-driven philosophy: “Base salary rewards effort, but bonuses reward outcomes.” It sets highly specific performance targets at the team, site, and individual levels to ensure bonus payouts reflect tangible business results.

3. Discretionary rewards:

3. Discretionary rewards:

You can choose a precise model, with strict KPIs tied to payout formulas, which enhances transparency but adds complexity. Or you can allow for managerial discretion to reward top performers who may not hit every metric (usually within certain limits).

Example: The aforementioned retail company uses a fully formulaic bonus model with no managerial discretion. Executive bonuses are determined solely by scorecard results, with no adjustments permitted. Employee growth is addressed separately through performance reviews and career advancement opportunities. On the other hand, an oil and gas company embraces a fully discretionary approach. Its bonus system includes a corporate performance component—based on company-wide EBITDA—and an individual component that is entirely manager-assessed. This gives leaders flexibility to recognize perceived performance beyond the metrics.

4. Year over year adaptability:

4. Year over year adaptability:

A stable model promotes consistency over time, aligning with long-term incentives. A more adaptable plan changes year to year, making room for evolving business priorities.

Example: A manufacturing company relies on a stable, scorecard-based model that has remained largely unchanged for years. While not perfect, it has effectively unified the company around core strategic pillars, ensuring short-term incentives stay aligned with long-term values. In contrast, an international airline takes a more dynamic approach. Its incentive framework is refreshed annually to reflect shifting business priorities—KPI weightings, as well as corporate and individual targets, are regularly adjusted. This flexibility allows the airline to clearly signal and reinforce what matters most in each performance cycle.

Each of these choices signals what your company values. There’s no one right answer—but the answers should be intentional.

Once the foundational elements of a short-term incentive plan (STIP) are in place, leadership must actively guide its design and execution. This involves a deliberate collaboration between the CEO and CHRO:

- The CEO defines the philosophy: What behaviors and results are we rewarding, and why?

- The CHRO defines and implements the structure: How do we translate that into KPIs, calculations, and funding models?

Keep It Simple—And Meaningful

Keep It Simple—And Meaningful

One of the biggest pitfalls in STIP design is over-complication. Leaders may feel tempted to add new KPIs and exception in the name of fairness. But they risk creating a system so complex that no one understands it. The most effective plans are not the most detailed, but the clearest. A good STIP tells every employee: “Here’s what we’re trying to achieve. Here’s how you contribute. And here’s how we’ll recognize your impact.”

Prepare for Pushback

Prepare for Pushback

Rolling out a STIP is rarely smooth. Some teams won’t like being tied to metrics they don’t fully control. Others will push for bonuses based on effort, not just outcomes. Legal, support, and back-office teams may feel disconnected from business KPIs. That’s okay.

Resistance is part of the process. It doesn’t mean the design is wrong—it means it’s real. The key is transparency: explain the tradeoffs, communicate the logic, and keep reinforcing the plan’s connection to strategy.

A STIP Is More Than a Bonus Plan

A STIP Is More Than a Bonus Plan

At its best, a short-term incentive plan is not just a way to allocate money. It’s a communication tool. It tells the organization: this is what matters. This is what success looks like. And this is what we’re working toward, together.

Yes, your company probably needs a STIP. But more importantly, it needs one that reflects your strategy, values, and goals—and gives your people a reason to care about the numbers they’re chasing.