At a Glance

-

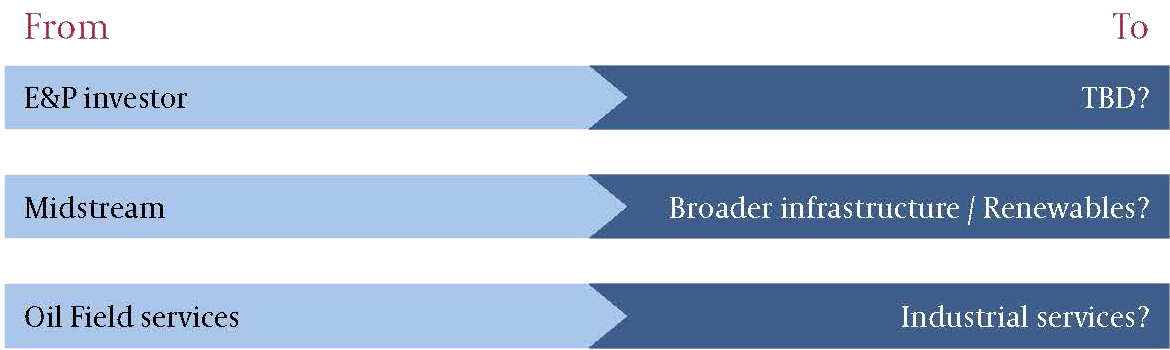

Energy investors are facing a transition period in their funds and in their careers, with existential challenges brought on by short- and long-term factors.

-

Pivoting to renewables is not a fail-safe answer, and options depend where investors are positioned in the value chain.

-

Infrastructure and midstream-focused platforms and investors appear best positioned for optionality, as the remit either already incorporates renewables or the investor skill sets are most similar.

-

Expert tips for how to pivot your firm and career.

Energy investors are on edge about the future of the industry and their careers. Funds and investors are watching capital flee the upstream and oil field service sectors and portfolios, which have limited liquidity and few exit opportunities. The longer term outlook is not much rosier: There is a fear that previous strategies won’t deliver returns and that limited partners may not support new fundraising, along with larger questions about the viability of hydrocarbons vis-à-vis renewables. How the future plays out for funds and investors depends on who wins the energy transition.

Winning the Energy Transition Investment Race

Winning the race, or even being a front-runner, will be tough; there are many stakeholders looking to capitalize. Let’s start with exploration and production (E&P)- focused investors. Can they pivot to–literally–greener pastures? For firms and individuals, the upstream private equity investment landscape is long on talent and short on opportunities today. We have had numerous recent conversations with investors at energy and generalist platforms who are losing their appetite for E&P, whether due to poor returns, unsuccessful fundraises, or lack of confidence in the sector.

A common question we hear from investors is, “Can I pivot to renewables?” Because this is a different industry, these types of transitions are easier for more junior employees who bring core analytical skill sets as opposed to those with longer track records and established networks. Further, the business model of upstream investors that works by backing teams doesn’t necessarily translate to other investing styles. One possible exception may be investors with expertise in E&P minerals, where the skill set and capability could be repositioned–rare earths and lithium minerals fund strategy, anyone?

Moving from E&P to midstream or infrastructure is a sound move, and we have seen several examples of individual investors leaving E&P-focused firms to move to firms with broader mandates. Current midstream-oriented investors may have a leg up as well, given the similarity of development projects, long-term contract structures, and the applicability of project finance, but a full E&P investor to renewables pivot is one we are still waiting to see.

One option for firms looking to pivot is to hire new talent with a renewables (or energy technology) background, but the CleanTech crash of the 2000s has littered the world with investors who have spotty track records. These firms might try to add people with a dual background in traditional and new energy (hard to find) or building separate teams (duplicative and expensive). Either way, principal investor searches are challenging for culture fit reasons, and layering on top the need for a good track record makes them even more so.

In Practice: For firms looking to pivot or expand via external hiring, thorough, systematic talent searches provide the inoculation against poor hiring decisions. For example, we recently worked with a leading, large global asset manager to recruit a Fund Head for a Renewables & Sustainability-focused fund. We found a candidate who had a deep understanding of the industry, investment themes, an excellent network, and a proven track record, which wound up being the exact fit needed. Spending time upfront with our client to understand the specification, and then getting into the market quickly led to a successful (and fast) result.

All that being said, there are healthy E&P investment firms where today’s malaise is likely more of a short-term issue given the paucity of capital leading to diminished exit opportunities. For those with capital, today’s valuations provide unique buying opportunities as well. Conversations with investors at these firms will reveal that they have conducted “deep dives” into renewables, and remain convinced in the necessity of hydrocarbon exploration and production for the foreseeable future. At least one notable E&P investor has personally deployed solar panels at his West Texas ranch to “disconnect from the grid,” perhaps more as a counterpoint with LPs since the project came in overbudget and was rife with technical delays!

Within oil field service-focused firms, the transition is a bit easier, as water-focused portfolio companies or technology-oriented investments may allow these groups to position their track records closer to the “green glow” that LPs are looking for. Shifting to focus on industrial services is another option, but these sectors are well covered by traditional industrial and bulge bracket funds. Energy services-focused firms can aid their transition by hiring people with broader industrial or service private equity backgrounds, ideally from investment platforms with strong track records and established non-energy brands.

There is industry buzz today around energy technology, the digital oilfield, or more broadly, technology and innovation being applied to all elements of the energy value chain. Within this sector, it is less clear which firms will win. Key challenges here appear to be scale and structure differences – late-stage venture and early-stage private equity checks are smaller (different deal mindset), firm hierarchies are different (PE is a pyramid, VC tends to be more top-heavy), compensation is lower, and portfolios are constructed to account for higher beta outcomes.

In Practice: We recently worked with an international pension fund to recruit a senior investment professional to execute an energy innovation and technology-focused strategy, a new area for the firm. The client needed someone with stellar investment skills and earlier stage experience of course, but also wanted an investor with prominent collaboration skills who could share insights from energy transition investments into other elements of the firm’s portfolio. It was a challenging mandate, but the fund’s unique strategy and investable capital generated lots of interest from the market (resulting in a quick hire), and is evidence there is exceptional talent available if one looks in the right places.

The sectors best positioned for today may be infrastructure and midstream-focused platforms and investors, as the remit either already incorporates renewables or the investor skill sets are similar (evaluating development projects and/or more yieldoriented investments). The challenge in this sector is execution, as infrastructure fundraising has set recent records, and the abundance of capital abundance may lower returns. Nonetheless, traditional infrastructure investors will be increasingly challenged on ESG pressures, given the public-sector closeness and regulatory constraints and longer-duration hold periods.

We are, however, noting quite a bit of talent interest for funds with Environment, Social, and Governance themes. Depending on the mandate, these platforms may be energy focused, or have multiple subsectors with energy being one. The challenge here is usually on the fund side; where do these funds sit with PE’s ultimate customers, LPs? Finding investors who have strong track records and a passion for broader impact is an area where we are seeing considerable interest, which often correlates with both early- and late-stage career individuals.

How to Pivot Your Firm or Career

So what should an energy professional do to become more marketable in this environment? We believe that investors who are experienced in energy technology and innovation may be best positioned as existing asset managers look to add expertise. New “start-up segments within existing asset managers targeted at energy transition investing, or allocations of new or existing funds may be a key area of growth for the industry.

What is an investor to do? Possible firm and individual career pivots

For individuals looking to make a change, here are some considerations:

-

Step back and take stock of “why.” Are you running from something (e.g., escaping the sector, a negative culture, a firm that is “stuck”?), or running toward a new opportunity that will expand your career horizons?

-

If your passion is to invest in a different sector, are their opportunities within the firm to raise a side-car fund, or at least test a new strategy with a limited pool of capital? Job searching is hard and time-consuming, so collaborating with current partners to experiment may be the most viable option.

-

Do I need to make the move in one-step, or is there a two-step path? For example, in a recent conversation, we spoke with an E&P investor who was considering moving to an infrastructure fund. Once there, his mandate over time could shift toward areas that aligned with his personal passion.

-

Timing is (almost) everything. In a few months, perhaps the E&P outlook improves, or in a few years, perhaps the appetite for energy transition investing cools. When managing one’s career, it is important to take stock of sector headwinds and tailwinds. For example, in today’s environment, energy transition or renewables investors with good track records should keep the bar high. Those in E&P firms may want to consider a broader set of options.

These are interesting times, as the talent needs at private equity firms are evolving quickly along with the changing short- and long-term energy investment landscape. For firms and for individuals, strategy and career decisions taken over the next year will have a significant–perhaps even existential–impact on their futures.

Todd Auwarter heads Industrial & Energy Private Equity at Egon Zehnder, and is a leader at the intersection of energy and private capital. He has led recent investment professional searches in renewables, energy technology, E&P, and infrastructure. Based in Houston, he assists clients across all sectors of the energy industry, including upstream, midstream, downstream, oil service and equipment, and power and renewables. Todd also conducts management appraisals and

provides accelerated integration support to transitioning executives.