It is a law of physics that a gas expands to fill its available space, and few energy transition technologies are demonstrating that property today like hydrogen. There is no simple way to put it, hydrogen is hot. With renewed interest from corporates, start-ups, and investors, there is also a renewed emphasis on recruiting top hydrogen talent. Where is the talent? How do we find it and attract it? And how are we sure we are hiring the best? All relevant and topical questions in the battle for talent in one of the energy transition’s hottest spaces.

Where is hydrogen talent today?

There are two ways to answer this question, first starting with the industry, and then a view on geography.

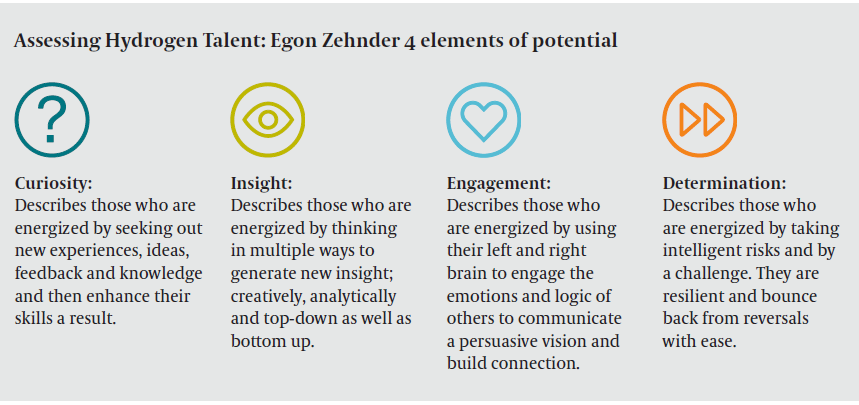

One of the first places one may think about talent is the industrial gas firms. With a long history in the hydrogen space, there is highly literate technical and commercial talent to be found here. That said, while the pool may be (relatively) deepest, for changeoriented start-ups and even strategics looking to pivot hard, one must question whether talent from an embedded traditional industry best serves future hiring needs. Robust assessment mechanisms, such as Egon Zehnder’s potential model, may shed light on specific individuals and their ability to adapt to changing environments. Related to this pool would be individuals at the oil & gas majors, often subject matter experts or generalists who are tapped to lead hydrogen efforts. In these firms, a one to two year head start on hydrogen may differentiate the “expert” from the novice, a gap that in time will surely close.

Another area of deep talent is the automotive industry, where organizations have been investing in the research to power fuel cell vehicles. In general, automotive hydrogen talent will spike as technology and engineering oriented executives, who will bring deep expertise but may not have the breadth that hiring organizations outside of automotive fuel cells seek.

The start-up world is replete with individuals who bring deep technology expertise, and in some cases founders who have made the leap to the CEO who can scale. This is the broadest, and most challenging hydrogen talent pool to evaluate. The difference between finding successful individuals who in the past bet on a flawed technology or business model vs. someone who is solid and happened to be in the right place at the right time is a monumental search and assessment challenge that in our view only good, old fashioned, behavioural interviewing and substantive, off-the-record referencing can uncover. Clearly talent coming from the fuel cell segment is deepest and most advanced, but compared to other industry sectors, it is still a niche, and one that has had more than its share of companies fail to fulfil their promise.

The energy technology generalist – the experienced Chief Technology Officer from an E&P company, oil field services firm, or industrial-energy conglomerate is also an appealing profile to consider. This is the engineer-manager, someone to build an R&D function, and

unleash scientists and engineers to do what they do best. Most good searches include a spot for the “best general athlete” and in the hydrogen world, while these leaders may not bring the technical depth and experience in hydrogen, they are grounded technologists, strong leaders, and know how to build effective organizations. Hiring managers are well-served to consider this profile.

On the more commercial and investing side, the energy venture capital landscape also proves a fertile hunting ground for hydrogen-oriented talent. While the number of venture capital or early stage energy growth funds that have committed hydrogen dollars may be low, almost all investors in the space have a familiarity with hydrogen through evaluating deals or doing sector deep-dives. One infrastructure investor, for example, pulled together a cross-industry, cross-geography team including its energy, infrastructure, technology, and regulatory leaders to evaluate the emerging hydrogen investment landscape. While investor talent is more commercially oriented and brings an appropriate level of investor scepticism, talent here generally spikes around financially and analytically-oriented leaders who may be good fits for roles with those profiles. Turning to geography, the start-up world sees clusters, especially technically, and often around key companies that are building local ecosystems. Examples here include upstate New York, home to Plug Power and the broader GE research facilities, or Vancouver, British Columbia with a diaspora centered around Ballard. Any energy transition observations would also be remiss not to mention more traditional talent hubs such as Boston or the Bay Area.

And while we’re talking about geography, there is a clear difference between North American and European pools, primarily driven by the European Commission’s coordinated emphasis and subsidy regime. Current immigration and work authorization challenges, not to mention COVID-related travel challenges, make these pools less likely to cross-pollinate in the near-term. (As an aside, particularly for those operating in the EU, an understanding of, and ability to navigate regulatory tailwinds is also a critical element to assess. More so than the “license to operate” for those coming from an oil & gas background, tomorrow’s hydrogen leaders must understand the emerging regulatory framework, position their companies and investments to capture subsidies, and be grounded in economics fundamentals).

Trade-offs while searching

Finally, there are questions of balance to consider across a few dimensions that cut across hydrogen talent pools.

-

Vintage – finding the ‘goldilocks’ level of experience. These candidates will bring the institutional knowledge of prior challenges that have faced hydrogen, yet not be too stuck in the ways of the past and cognizant of the factors that make today’s hydrogen opportunity set different.

-

Technical acumen (often bringing the requisite PhD.) vs. commerciality. Finding candidates who can straddle the engineering and financial worlds can be tricky, and some organizations are building balanced hydrogen teams with individuals in both areas versus trying to solve with a single “unicorn” candidate.

-

Blue vs. Green, or both? Talent will need to be increasing literate across the hydrogen opportunity set, and longer term viewing blue as a bridge fuel on the way to a green hydrogen future will see the talent pools collapse. In today’s market, however, given the novel nature of hydrogen experience, hiring managers may need to be a bit ‘color blind’.

One other area of emerging talent needs will likely be around carbon trading and energy optimization. Full-suite energy management organizations aspire to offer customers energy as a service, taking into account carbon footprint and expected budget, and requiring a full understanding of how the value chain integrates. Navigating emerging carbon pricing and trading opportunities will be a skill set demanded by the future.

The age-old question of attracting talent depends purely on the role and company that is doing the recruiting. Developing a pithy pitch, understanding the organization’s balance sheet and investment commitments, and also regulatory strategy will demonstrate commitment to hydrogen for the long-run.

Conclusion

As a technology and fuel source, hydrogen has been noted to be the energy transition’s oldest new technology. Finding hydrogen talent, whether old or new, remains as elusive as hydrogen’s promise. However, a smart search strategy to understand the likely profile and where to find it, along with strong assessment mechanisms, provide tools to help solve hydrogen’s talent challenges that will help unlock its potential as an energy source of the future.