Over the past year we have witnessed tremendous progress with all entities on the PSI20 meeting their required diversity quota. There is now a foundation for taking an important leap forward in creating Evergreen Board Succession and building the pipeline of the next wave of women leaders.

We heartily congratulate the Boards and CEOs of the PSI20 on the progress made over the past year!

It’s amazing what a difference a year can make! In the prior version of this report (2018) eleven of the PSI20 companies on the Lisbon Stock Index were not compliant with a recently established law requiring all publicly listed companies to have at least 20% of their Board seats filled by women in 2018.1 In a matter of a year all of them met this mandate.

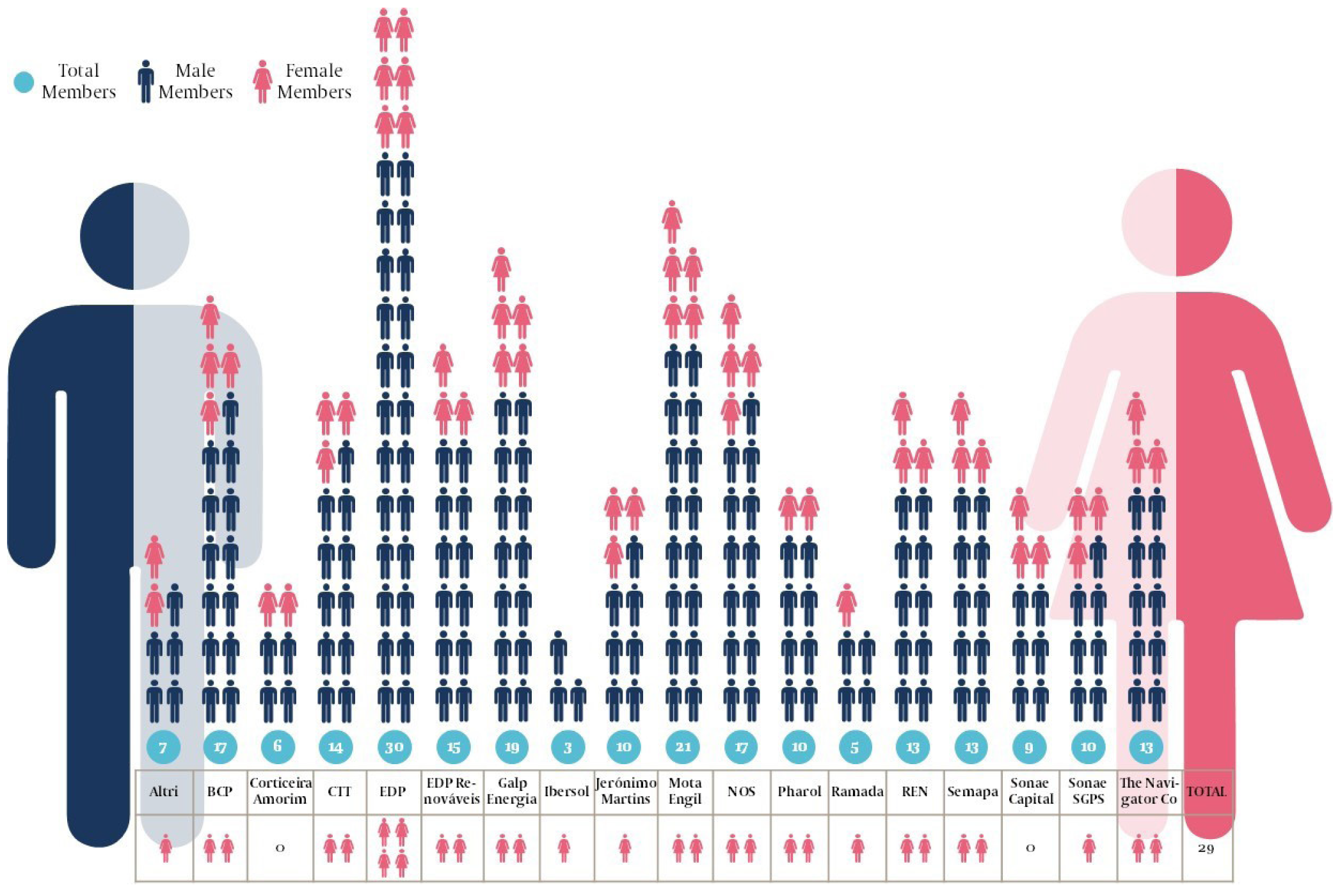

The next challenge will occur in 2020 when companies on the PSI20 must have 33% women represented between Executive and Non-Executive Board Directors. That translates into a need to find 29 great and ready-now women leaders. How will this be addressed? What are the options? And how can the Chairs, Nominating Committees and Chief Executive Officers seize this opportunity to solidify corporate governance?

In Portugal there are a couple of specific issues that make addressing this more complicated than just having the will to make it a priority. It starts with a limited number of candidates in Senior Executive roles. The data is striking. For instance, as of June 2019 Portugal had only one sitting female CEO, and two CFOs among the PSI20. While Portugal is not alone in having a restricted pool of senior women executives, the scale of this gap is extraordinary in comparison to other countries in our most recent assessment.2 So this means that Boards, will have to be more creative in their solutions. Based on Best Practices from around theGlobe, Chairs and Nominating Committeesin Portugal should review their Board nominating processes.

The next challenge will be in 2020 when there will be a need to nominate 29 new women to these Boards

What we see elsewhere are Boards seizingthe drive for gender diversity as an opportunity to create ‘Evergreen Board Succession Planning’. In combining these two themes, there is a powerful business case for getting ahead of the curve. In Portugal, early adopters who recognize this opportunity will have a first moveradvantage in addition to bottom line, branding and customer benefits.

One way to solve this is to consider hiring internationally where the candidate pool may create some interesting opportunities. But experience tells us this may not be easy. In fact, Portugal has the worst record for attracting non-Portuguese nationals to Boards – 18% compared with the Western European average of 36% – and does not have a single foreign national in CEO roles.3 Accordingly, Board Chairs and Nominating Committees need to double down on their efforts to access the best talent. We know it can be done!4

This leads us to the most important conclusion that any conversation regarding diversity inevitably leads to: the problem of the pipeline.5 Below the C-Suite several hurdles are making it hard for women to progress up the hierarchy. Some of these are social pressures, some are cultural roadblocks, and some reflect a lack of internal support structures within companies that can accelerate more young women into roles of greater responsibility. Addressing this is critical if we are going to create a sustainable long term solution. But it will not solve the problem in the near term. Hence, beyond turning to international talent, what else could be done?

Addressing the Pipeline below the C-Suite is critical to creating a sustainable long-term solution

Board Composition of the PSI20 by Gender

Without more regular Director turnover, Boards are unable to adjust their competencies to match the pace and extent of change in business today. Cybersecurity, Digital and Activists are just some of the themes overwhelming Boards. Active Board refreshment addresses this challenge by combining anticipated Board turnover with structured Non-Executive Board Member succession planning. It involves building a better Board Competencies Matrix that goes beyond “experience” and the “reputation” of candidates to include looking for “disruptive forces” that make for a forward thinking Board. It also requires casting a wider net beyond “the people we know”, and conducting a more objective assessment when nominating external members. While this is not complex as an approach, it is surprising how few Boards apply a robust succession plan as a way to get ahead of issues. As a result, regulators are mandating the disclosure of Board Succession plans following the global financial crisis. This may be next on the agenda for the stock exchange regulators (such as CMVM in Portugal) and is already on the ECB agenda for key functions (Risk, Audit, Compliance).

Egon Zehnder is ideally placed to advise Boards on these efforts. We are a world leader in Board and Diversity placements, both in Portugal and abroad. We have made it our business to know the pool of relevant candidates: we understand their desires and know their skills because we have been in the Portuguese market for 30 years. Given the need to go beyond the traditional feeder pools, we are best placed to co-create innovative solutions in Portugal. And with our international reach and experience we have the most well informed insight into the range of candidates outside the country, whether they are Portuguese nationals residing abroad, or just simply excellent candidates.

The drive for Diversity is an opportunity to improve governance and create Evergreen Board Succession Planning

Footnotes

- For the relevant legislation see: Decreto No. 119|XIII, 23 Junho 2017

- Egon Zehnder Global Board Diversity Tracker: Wh0’s Really on Board? (2018); available online at egonzehnder.com/ global-board-diversity-tracker

- Idem

- We refer to Jerónimo Martins where currently nearly half the Board are foreign born, and emanate from several different countries thereby addressing diversity beyond gender.

- While women comprise approximately 45% of entry level professionals by the time they are just below the C-Suite the percentage is cut in half (Global Gender Report, 2018 World Economic Forum)