Quite often, board succession planning consists of a member announcing to the board that he or she plans to retire next year, and the board then gearing up to find a replacement (who typically differs from the retiring director only in being a few years younger). What if, instead, your board adopted an ongoing, evergreen process of planned renewal, carefully assessing board competency and experience needs and mapping a strategy for addressing them years in advance?

Like many oversight bodies, corporate boards are slow to change by design. The board’s mandate is to take the long-term view, which is reinforced by a high level of continuity in its composition. In a less disruptive time, this approach carried little cost. Today, however, radical changes in business models, industries, customer expectations and technologies are unleashing massive shifts from which no business is immune. These changes and challenges can leave boards vulnerable and out of sync with the environment in which the company operates.

At the same time, aligning the board’s capabilities and experience with the company’s strategy and environment has become a higher priority for both regulators and investors. Beginning with the 2010 proxy season, the U.S. Securities and Exchange Commission required companies to disclose for each director and director nominee “the particular experience, qualifications, attributes or skills that led the company’s board to conclude that the person should serve as a director of the company.”

Further, proxy access provisions allowing the direct nomination of director candidates by qualified investors have become increasingly common. A study by Sullivan & Cromwell issued in April of this year found that since the 2015 proxy season, 200 public companies have adopted some form of proxy access, compared to a total of only 15 companies before 2015. Similarities between these provisions suggest that norms are forming, which could help make proxy access a standard corporate governance best practice.

Shareholders and their advisors are also quick to frame board underperformance as a board composition issue. In April, Institutional Shareholder Services came out against the reelection of the nominating and governance committee chair of Chipotle Mexican Grill, saying that the company’s prolonged food safety troubles “exposed a flawed board succession process that has not allowed the directors’ skill sets to keep pace with the company’s size and complexity.”

Similarly, activists have found citing a “poorly constructed board” to be a powerful platform from which to propose a dissident board slate or demand direct representation. Board composition, which not long ago was more or less the exclusive, behind-the-scenes territory of the board, is now fully in the open and subject to vigorous scrutiny and debate.

Without more regular director turnover, boards are unable to adjust their competencies to match the pace and extent of change in business today.

It is true that in the past several years, many boards have greatly professionalized their director succession planning. Too often, however, those succession plans are left sitting on the shelf.

While directors may face election every year or every three years, unless a director is under attack from an investor, the reelection of the management slate is usually a formality. Lulled into complacency, for many companies shaping the board is episodic at best. Without more regular director turnover, boards are unable to adjust their competencies to match the pace and extent of change in business today.

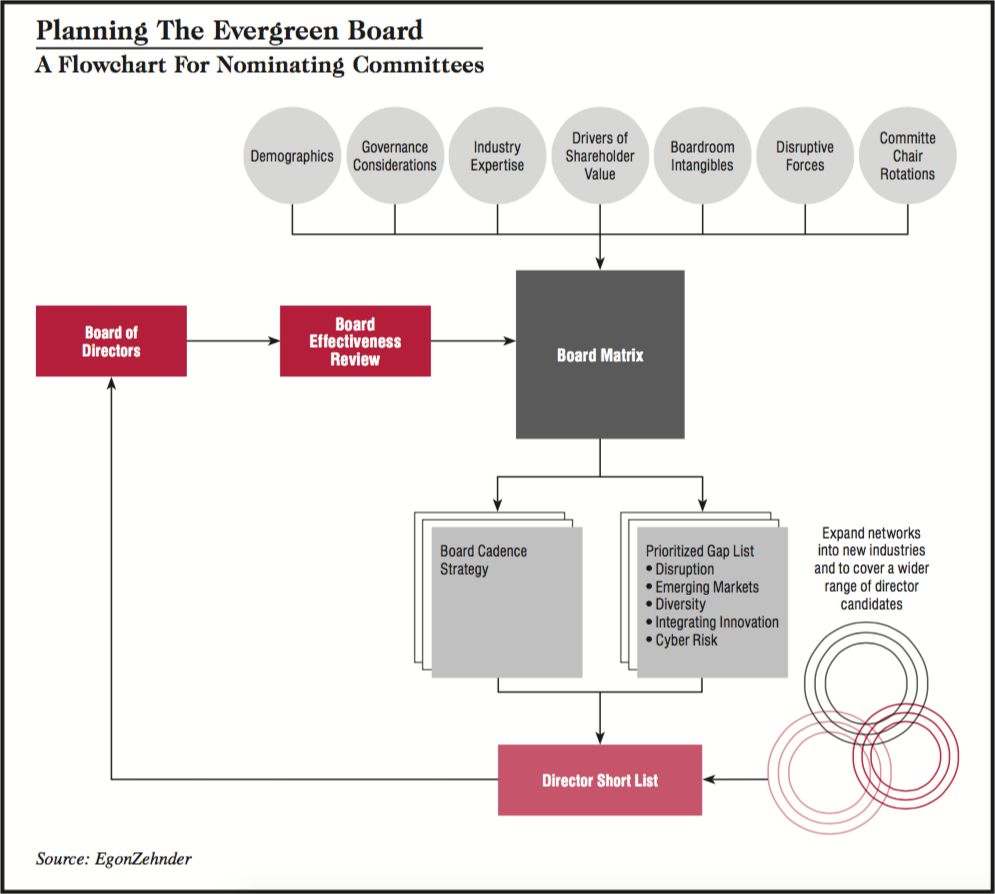

Board refreshment addresses this challenge by combining anticipated board turnover with structured director succession planning. This changes the election of new directors from a tactical response to events such as retirement or an investor battle, into a more sophisticated plan that incorporates a broader range of strategic considerations. Just as we all regularly review and reallocate our investment portfolios, board refreshment provides a mechanism by which boards can ensure an ongoing balance between preserving continuity and injecting fresh ideas for a world that is increasingly volatile, ambiguous and competitive.

A true, ongoing board refreshment strategy is more than just director succession at more frequent intervals. Managing board composition to match the current pace and extent of change requires adjustments throughout the director succession process.

Build a better matrix. Nominating committees typically begin the succession process with a board matrix listing the qualities by which current and prospective directors should be evaluated. If the matrix is the benchmark, it must accurately represent the needs of the board in meeting the company’s strategic plan and business environment. Nominating committees must therefore go beyond the standard board matrix categories of demographics, board service and industry experience to include other elements such as:

-

Drivers of shareholder value, such as operating excellence, managing expansion into new markets or regions, or integrating multiple entities into a single, unified organization.

-

Disruptive forces, including managing digital transformation, creating and adapting to new business models, or leveraging the changing expectations of the end user and other players in the value chain

-

Intangible qualities that make for a forward-thinking board, such as diversity of thought and the ability to find common ground between factions, pull the board back from group think or to effectively champion innovative ideas.

-

Committee chair rotation, taking into account possible domino effects of retiring chairs.

-

Conduct a more objective assessment. The more informed the assessment of directors is against the matrix, the more accurately the nominating committee can identify the current state of the board and its strengths and gaps. Rather than relying on self-assessments that are highly subjective, and can be compromised by self-interest, nominating committees find it helpful to have a third party conduct confidential, one-on-one interviews with each director. These interviews can help a board see itself more objectively, as outsiders do. They also make each director’s evaluation in the matrix more nuanced and reflective of the director’s complete contribution to the board.

The “been there, done that” allure of the CEO is strong, but casting a wider net means loosening demands that the director be a sitting or retired CEO.

Cast a wider net. Board refreshment fails if it simply replaces retiring directors with younger versions of the same. The goal is to create a board more oriented toward the future than the present, and with a menu of viewpoints that allows for creative thinking. Casting a wider net for director recruitment is likely to take more concerted effort than many nominating committees realize, however.

Expanding the director pool unfolds along two dimensions. First, the board’s network should reach into new industries to include executives who are tackling cutting-edge issues in disruption and innovation.

For example, companies that need to strengthen their guidance on new business models within a regulatory environment could look to the leaders of the new generation of nimble, monoline fintech companies. These enterprises are unbundling the services traditionally offered by larger institutions. Legacy companies seeking a culture of innovation can look to industrial companies like GE and Honeywell that have successfully retooled themselves for the Internet of Things.

Casting a wider net also means loosening the default requirement that the director be a sitting or retired CEO. The “been there, done that” allure of the CEO is understandably strong. Yet nominating committees will find that other C-suite leaders can also make substantial contributions to expanding the boardroom universe, and to making the board more agile and future-oriented in its thinking. For example, we have seen a notable uptick in the recruitment of chief information officers to boards where they can offer experience with the digitalization of business, the rise of Big Data and the mitigation of cyber risk.

Stay evergreen. The Achilles’ heel of the standard board succession plan is that, unless there is investor pressure, boards usually only evaluate their composition in anticipation of a director retirement. Today, though, institutional investors and activists thoroughly evaluate the boards on their radar screen whenever they feel it is warranted by events. Thus, boards must evaluate their own composition on a regular basis, and through a critical lens. How does the board’s collective industry expertise and average length of tenure look to an activist? Does the board’s agility and range of perspectives seem to be a good match for transformation the industry is experiencing? How does the board look when compared to its competitors?

If the nominating committee answers such questions regularly, it will always have an up-to-date view of the board. In addition, the board matrix itself is not a fixed document; it should be reevaluated annually to reflect developments in the strategic plan and business environment.

A real-time comprehensive gap analysis allows the board to be more deliberate and thoughtful in building a pipeline of candidates and in evaluating those candidates. It also permits the board to be more opportunistic in recruiting directors as they become available, even if a little ahead of the board’s schedule. This flexibility prevents the board from having to recruit from the more limited pool of candidates that happen to be available when a director retires.

Remember, however, that board refreshment cannot be conducted as a purely analytical exercise. The nominating committee must weigh both the tangible and intangible effects of replacing a sitting director, including that director’s areas of influence on the board, his or her effect on overall board chemistry and the need for continuity.

Both nominating committees and boards need to be prepared for greater “care and feeding” of the director succession process.

Adopt a “war room” mentality. Connecting the board’s composition to both the pace and extent of change means that many nominating committees will find themselves covering a wider swath of ground and with greater urgency. More frequent revision of the board matrix requires the board to be more forward thinking and sensitive to changes in the business environment as they appear on the horizon.

Gap analyses need to be conducted more often. Networks are broader, and involve tracking more director candidates, some in industries that may be new to the nominating committee. Both the nominating committee and the board as a whole need to be prepared for the greater “care and feeding” that board refreshment requires.

Change the culture. The board chair and nominating committee chair should position board refreshment as a change in the culture and workings of the board, rather than as a censuring of individual members. The unspoken view of a directorship as close to a lifetime sinecure needs to give way to an ethos that regards the ability to step down gracefully as a hallmark of good directorship. This culture shift is reinforced by establishing a cadence for director succession. If regular turnover becomes the norm for all board members, it carries no stigma.

Some boards may argue that having mandatory retirement ages addresses the refreshment issue. These policies fall short for a number of reasons. Some of the boards with mandatory retirement ages are raising them from the traditional 72 to 75. Changes in health and longevity may well mean that age becomes a less useful (and defensible) measure driving refreshment. Finally, if the search for directors signals a generational shift in the boardroom and the average age of directors moves downward, age limits will become increasingly irrelevant.

A handful of public company boards have gone so far as to institute director term limits. Whether or not this approach takes hold remains to be seen. Boards may decide that it is too mechanical and fits poorly with the need to maintain the board’s autonomy and chemistry. In that case, however, the onus is on the board to manage its own refreshment in a way that ensures that board composition keeps pace with the outside world. If a board does not take charge of this aspect of its governance, it can expect that investors will fight to do the job.

Evergreen boards set a cadence of director turnover that balances continuity with the need to close gaps in board capabilities.

Refreshment in action. A board’s embrace of a refreshment strategy often is triggered by an event that puts refreshment’s benefits in sharp focus. Egon Zehnder’s board practice was contacted by the CEO of a Fortune 50 firm when it became apparent that activists were looking closely at the company. We were charged with helping the board get out in front of any action that activists might take based on board composition.

First, we expanded the board matrix to include experiences and qualities that drive shareholder value, reflect the company’s current environment and build an agile, forward-thinking board. We then conducted a thorough assessment—through the eyes of an activist—of each member of the board.

This identified directors who were prime targets of activist action due to length of tenure, the number of boards on which they serve, or because they had been the target of previous shareholder votes or their competencies were no longer aligned with the company’s strategy. The nominating committee then established a cadence of director turnover that balanced the need for continuity with the imperative to close gaps in the board’s capabilities.

This approach helped defuse rising tensions between activists and the board. More importantly, however, it changed the culture of the board. Directors now come on to the board thinking differently about the length of their service, and evaluation of the board against its needs takes place on an ongoing basis.

A global manufacturer we advise adopted such an evergreen approach to director succession not due to activist action, but simply because it sought a more thoughtful, less transactional approach to the board’s composition. As in the previous case, we began by creating a new board matrix that emphasized the issues the company faced.

We then interviewed each director to get more comprehensive insight into his or her contributions to the board, and advised the nominating committee on the qualities and experiences to look for in new directors. The board then began an ongoing director identification and relationship-building program to broaden its pool of director candidates. Combining a long-term, strategic view of the board’s needs with continual research into new candidates allows the nominating committee to take a more opportunistic approach to director recruitment.

In the last two decades, boards have evolved significantly to meet rising investor expectations. A large part of that evolution has centered on how boards think about and manage their composition. An “evergreen” approach is an essential refinement of the director succession process that keeps boards in sync with a fast-changing and increasingly competitive world.