CEOs are the mainstay of their companies – both externally and internally. They hold primary responsibility for developing and implementing forward-looking strategies and evolving corporate culture. And in our hyper-complex and fast-paced age, they are the voice of the company and architects of value creation that goes well beyond financial gain. Appointing the CEO is one of the most important decisions and extensive tasks of any board of directors.

Background

The CEO succession process presents the board of directors (BoD) with various antagonisms that could hardly be more challenging. The board has to juggle substantive decision-making criteria with procedural and formal requirements. Then there is the fact that various stakeholders are directly or indirectly affected by succession planning. They need to be informed, updated and in agreement on the required CEO profile, yet at the same time the selection process demands the utmost confidentiality. On the one hand, rational selection criteria play a major role; on the other, the process of assessing and selecting the right candidate is also an emotional decision. Decision makers have to focus on the company’s current challenges, while also keeping future needs in mind. They need to emphasize the right topics (technologization, disruption, sustainability, future market environment, structural and social changes, megatrends, etc.), but also maintain high revenues and profitability.

This means that the board of directors in particular requires experienced, strategic thinkers, ideally visionaries, people who are highly self-reflective and know where they are heading with their company. The board needs people who engage in a courageous and constructive dialog with all stakeholders.

Overview and challenge

Identifying, approaching and selecting CEOs is part of a complex process encompassing a wide range of risks and opportunities. The right mix of technical and leadership skills, of personality, potential and mindset around the CEO role is essential in order to master the enormous current and future challenges. CEOs who see themselves as “superheroes” will quickly find themselves out of their depth in the face of societal shifts, technologization - including disruption of entire industries - and growing sustainability requirements. Today’s leaders need instead to inspire others to perform at their best, and they need to remain flexible themselves. Successful CEOs need a diverse skill set that equips them for the entrepreneurial challenges in the years ahead. We cannot model exactly how our world will look in the future. But we can pinpoint five challenges that CEOs and to some extent other C-suite roles will have to address:

- Link the business objective to a higher purpose (social value) and align all activities and communication accordingly

- Reduce and manage the complexity of various factors affecting business performance

- Strengthen employees’ emotional attachment to the company to achieve better intrinsic motivation

- Promote innovation and orchestrate creativity

- Develop and motivate qualified leaders and successor generations

The board of directors should always keep these challenges in mind when searching for the right CEO. It makes sense to invest in a well-considered and carefully planned succession process: the right choice of CEO adds value for all the company’s stakeholders. Conversely, the wrong choice can have a negative impact on the company’s reputation, positioning, strategic orientation, corporate culture and ability to attract talent. Ultimately, the company’s very value is at stake with the CEO selection. Considering the following criteria helps increase the likelihood of appointing a CEO that adds long-term value:

Timing

Practice shows that a proactive approach is advisable, i.e. one where action is taken from a position of strength and foresight. Under no circumstances should an organization wait until succession is inevitable and a reactive solution needed.

Responsibility

Whether or not to include the incumbent CEO in the decision-making process depends on the type of company as well as some regional factors. In the US or even Switzerland, the CEO is sometimes part of the decision-making body but not the shareholders’ meeting following the proposal of the nomination committee. One critical point is the role of the chair of the board of directors, who is responsible for the CEO selection. What requirements can the chairperson define? Does the chairperson always sit on the nomination committee? And what influence does he or she exert in designating the chair of the nomination committee? There is no one best answer to these questions, and the Swiss Code of Best Practice Governance does not provide clear recommendations either. However, any governance should be conducive to the open and creative dialog that is so important in the run-up to a successful appointment.

Objective

A good succession process is built on well-defined strategic objectives for succession. These are also the basis for deriving the requirements for the CEO role. The succession process should not begin until all stakeholders on the board of directors, and ideally the incumbent CEO, have agreed on them unanimously.

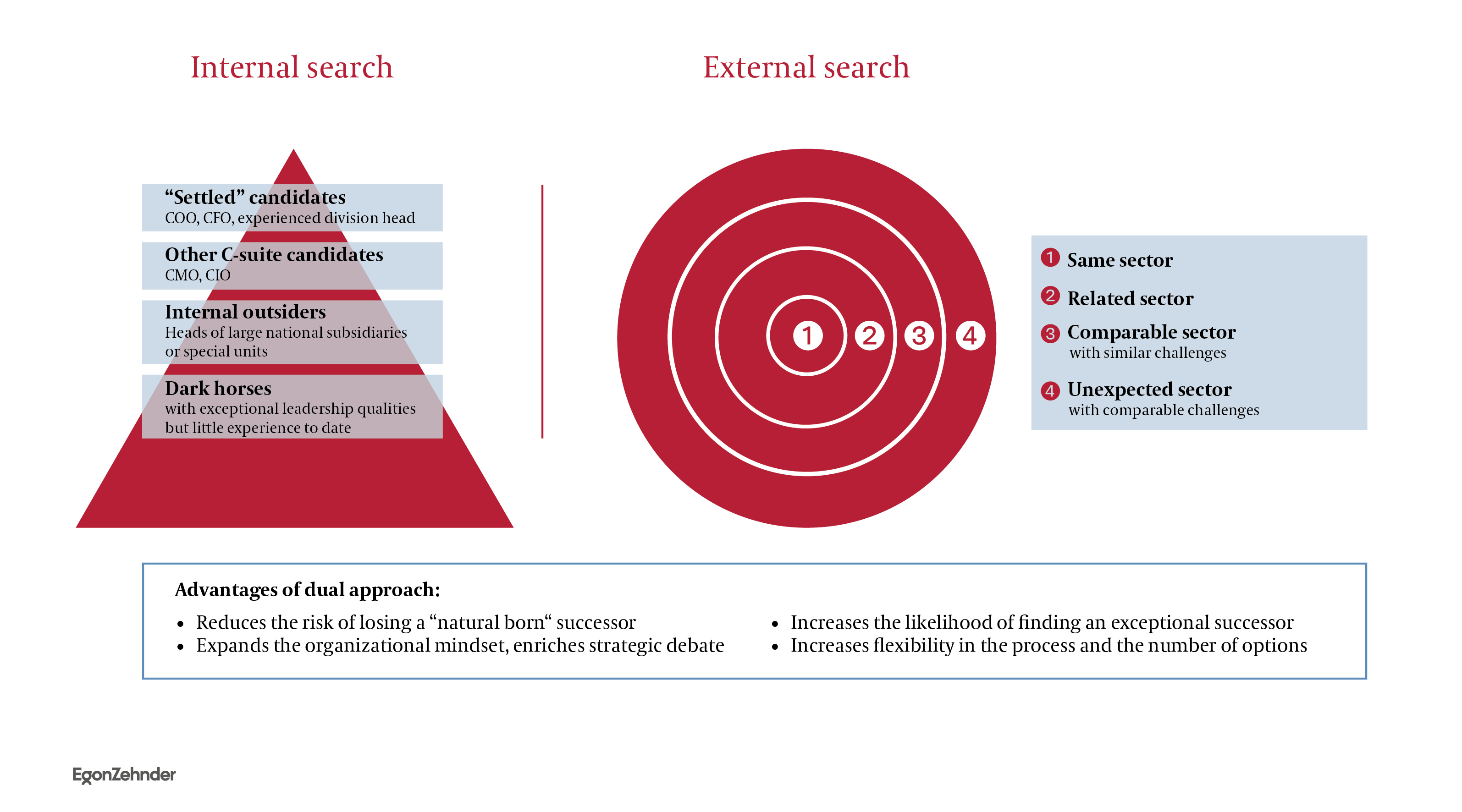

Internal and external candidates

In 80 percent of cases, the CEO succession decision falls in favor of an internal candidate. Internal search areas range from typical candidates such as the COO, CFO or other members of the C-suite to outstanding division heads and regional leaders or even “dark horses” whose outstanding leadership qualities have already made them stand out despite limited experience. To keep the onboarding effort in check, the search typically starts in the same or similar sectors for external candidates as well. However, it can be worth exploring other sectors, for example to find someone with experience in dealing with disruptive market changes. On average, external CEOs will offer a broader perspective, while internal candidates naturally come with significantly more knowledge about the company. Some studies suggest that internal candidates perform somewhat higher in terms of shareholder return than CEOs brought in from elsewhere. At the same time, getting an external candidate on board can prove advantageous in change situations. Whether internal or external – those candidates that survive the many pre-selection stages ultimately make it onto the shortlist for the board’s final decision.

Candidate assessment

In assessing a CEO candidate shortlist, there are four to five strategic leadership and key competencies that play a central role. However, the ideal candidate profile is no longer just about what someone has achieved in the past and how. The most important thing is whether a CEO has the potential to respond appropriately to future challenges. Besides aspects such as the will to achieve goals, interpersonal skills and persuasiveness, and an ability to cut through complexity, it is curiosity that determines whether someone will be a successful leader. The nomination committee should draw on competency matrices and potential grids to assess candidates, although overly extensive and complex criteria catalogs are not recommended. A useful tool for managing and visualizing the process is the “candidate monitor”. This method allows both internal and external candidates to be mapped on a matrix of defined competencies, which also shows the availability of the candidates. Users see at a glance which high-potential candidates from the second and third management levels are suited for promotion to the very top. Over time, those with both the necessary potential and immediate availability move into the monitor’s shortlist area. A simplified pre-selection process like this leads in best-case scenarios to a systematically prepared decision that can then be confirmed after careful consideration. The substantive assessment of candidates should also rely on the nomination committee members’ instincts, experience and general understanding of human nature. It can also be helpful to have a professional and independent third-party review of the defined core competencies and potential indicators using 360-degree competency-based reference interviews.

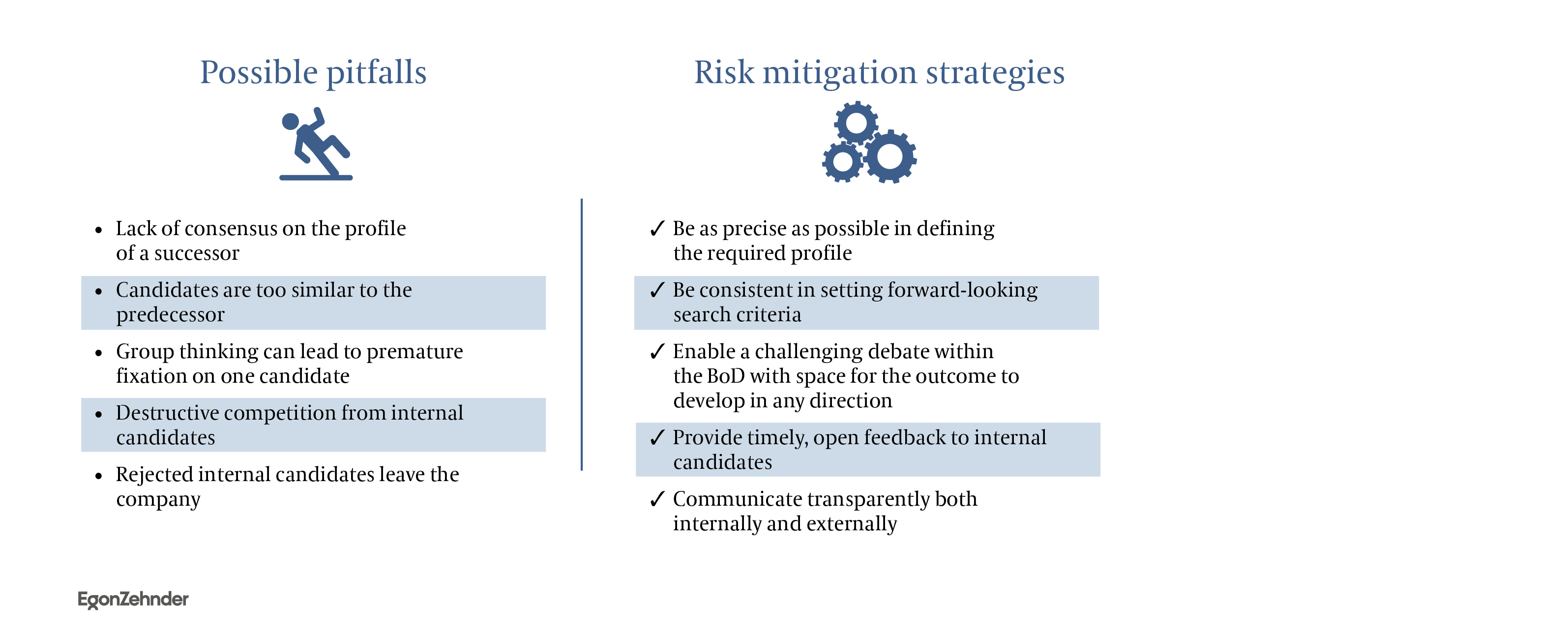

Potential risks and risk mitigation

There are certain risks inherent in any CEO succession process. It is neither realistic nor desirable to reach absolute consensus on what the new CEO should look like because consensus candidates are not usually strong ones. Nevertheless, it is important to hear the voice of everyone involved in the process. Developing the ideal profile means creating one that resonates with as many stakeholders as possible. After all, the success of the strategic renewal process – which goes hand in hand with every new CEO appointment – depends on it. Experience has shown that another risk can only be contained to a limited extent: covert or even outright competition between several internal candidates. That candidates strive to position themselves in the race to the future top spot is unavoidable – and can be destructive. The final stage in the escalation can see those who fail to become CEO leaving the company. Right from the outset the board of directors should consider the threat of damage if one or more near-CEOs resigns. Open communication with internal CEO candidates is strongly recommended as a very minimum but is still no guarantee that supposed “losers” will not choose to leave the company to seek new challenges elsewhere.

The modern BoD’s active role in CEO succession

For a long time, contentious discussions were a rarity in rather homogeneously composed boards of directors; even the CEO succession was primarily determined by the board’s chairperson. The board focused on presentations, reporting and any essential resolutions. Over time, board meetings took on a more functional character; sub-committees started getting involved outside regular meetings, and succession planning became a topic for bilateral discussion between board chairs and CEOs. Diversity of perspectives is expressly desired in today’s “state-of-the-art” boards of directors. Presentations now serve, at best, to spark subsequent discussions, while ongoing exchange takes place for the good of the company. Succession planning in particular now follows a professional, robust process under the lead of the chair of the board of directors or the chair of the nomination committee.

Feedback and dialog: The role of the chair of the BoD

There are several points in the succession process where active and transparent communication by the chair of the board of directors is essential. As explained above, the chairperson should take a preventative approach to address the threat of damage caused by the departure of one or more near-CEOs, for example. As soon as the new CEO has taken up the post, the exchange with that individual also becomes of central importance. Every change of CEO forces the complex system of a company to adjust and adapt to the new leader. The reverse is also true and the CEO has to adapt to the new environment. Open and periodic feedback is of crucial importance even beyond the onboarding phase. However, it is likely that the CEO’s new employees will be limited as honest providers of feedback. So it is all the more important for the chairperson of the board of directors to take responsibility and support the new CEO as a capable sparring partner well beyond day one. This approach enables the chair not only to plan the CEO succession well in advance, but also to play an active and formative role during the winning candidate’s term of office.

This article was originally published in: KPMG Board Leadership News Edition 01/2021

Publication on our website by kind permission of KPMG AG.