While board diversity encompasses a wide range of characteristics, including demographics and personal and professional attributes, gender diversity has been one of the earliest and the most discussed dimension of diversity in the past 20 years. In spite of all of the discussion and research, companies are still trying to make the link between board diversity and firm value. In our work with boards around the world, we believe diverse boards lead to deeper discussions, more perspectives and better decision-making. In this article, we take a look at the board diversity landscape in Greater China and other countries and how gender diversity has impacted financial performance.

What the Evidence Says

While some studies suggest that gender-diverse boards allocate more effort to monitoring, the average impact of gender diversity on firm performance can be negligible, especially for companies that are already well-governed. Thus, whether board diversity increases firm value depends on co-existing internal and external factors, such as firm and board characteristics, business conditions, goals, and constraints, among others.

Regulators, institutional investors and academic researchers have launched various initiatives to increase gender diversity on the boards of publicly listed companies, including mandatory legislation in countries such as Norway (2003) and Spain (Law of Equality enacted in 2007), which requires 40 percent female directors for listed companies and recommendations and disclosure requirements in others, including the UK, Japan, Germany, Australia and Hong Kong.

Besides regulators, Institutional Shareholder Services’ (ISS) revised polices for the 2021 proxy voting guideline recommended withholding votes against the companies in the Russell 3000 or S&P 1500 if there are no female directors on a board (an exception may be made if there was a female director in the previous year and with a commitment to restore within the following year). Goldman Sachs announced in 2020 that it will not take companies public anymore unless they have at least one “diverse” board member. In August 2021, the U.S. SEC approved Nasdaq’s proposal to improve board diversity, including disclosing board diversity statistics. Despite these efforts, the impact of board diversity on firm value is still unclear, and research on this topic is complex due to its endogeneity.

Quasi-empirical analyses on the effect of implementation of gender quotas in Norway, Spain, California, for example, can provide good references to understand this topic better. In December 2003, the Norwegian Parliament required all public firms to have at least 40 percent representation of women on boards by July 2005 (at the time of the announcement, women only held 9 percent of board seats). The limitations imposed by the mandatory quota caused a significant drop in the stock price at the announcement of the law. In addition, the effect lasted for several years and had a significant decline in Tobin’s Q because the quota led to younger and less experienced board directors, increases in firm leverage and M&A activities, and harmed operation performance in some cases. The announcement of the first mandated board gender diversity quota in the U.S. (California Senate Bill No. 826) also resulted in negative returns, with even greater declines for companies that need more or have difficulty finding female directors, a study found. However, the increase in female board members in Spain improved economic results, based on a sample of 125 non-financial firms listed on the Madrid Stock Exchange from 2005 to 2009 when Spain enacted the Law of Equality in 2007.

Spotlight on Greater China, HKEX Listed Companies

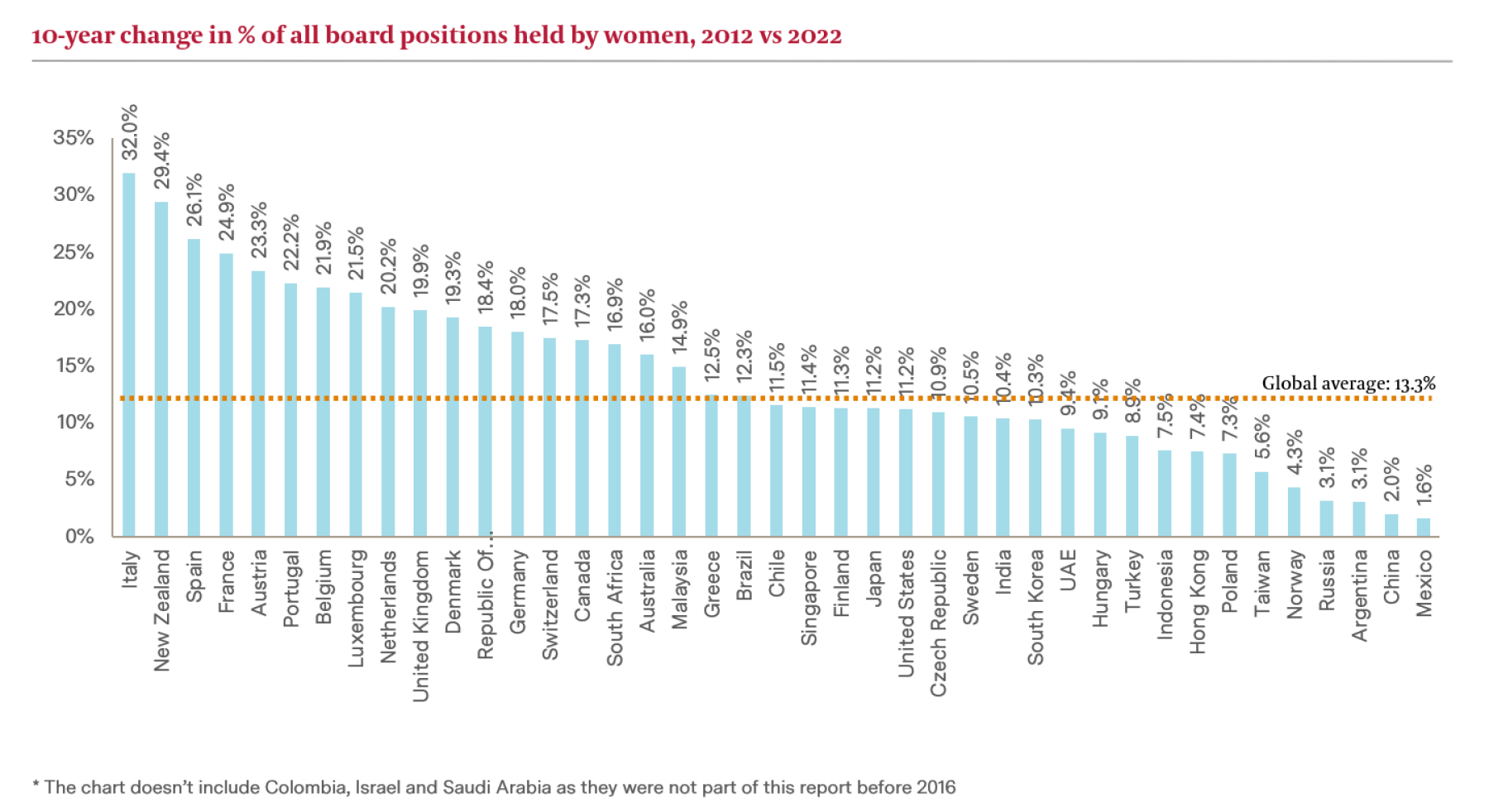

Egon Zehnder’s biennial Global Board Diversity Tracker shows that both Hong Kong (7.4%) and Mainland China (2%) are both below the 10-year improvement average in the percentage of board positions held by women globally (13.3%).

As of January 2023, over 25 percent of the 2,613 HKEX listed issuers have no female representation on their boards, while only 16.4% of board positions are held by women, far below the global target of 30%.

Why are the changes of board gender diversity not happening more quickly, especially for Greater China companies?

Board structure and composition considerations are impacted by firm characteristics, business conditions, and preferences of investors and internal and external stakeholders (e.g., chair, board directors, management team, external regulators). In addition, firms may face the constraints of supply, for example, smaller firms or niche industries may face local labor market limitations in finding directors with specific types of experience. There is also recognition that women’s underrepresentation on boards varies by sector. When boards are looking for similar qualifications in their next director from a pool of CFOs or CEOs with similar scale of experience, reasonable distance (mostly from local) and availability to serve as a board director (e.g., have the approval from their serving company if they are still sitting executives), then the pool of qualified candidates is limited.

From the demand side, the long-serving board members’ reluctance to retire can inhibit diversity appointments if the board is not triggered by external institutional pressure (e.g., external security laws and guidance or the push from foreign institutional investors). In addition, the chairs and directors have the tendency to only look through their own networks to find the trustworthy or “loyal” candidates to them. A 2016 study, Playing the Boys Game: Golf Buddies and Board Diversity, finds that the likelihood of a woman serving on the board of a large-size firm or in a male-dominated industry rises drastically if she plays golf, as a proxy for internal social networks based on analysis of Singapore listed companies.

Considering the cultural and social background, Japan’s gender diversity on boards is also a good comparative reference. Yukie Saito examined the listed companies in Japan to explore the impact of institutional change on board gender diversity. With increasing shares of international shareholders in Japan listed companies on the Tokyo Stock Exchange (almost 27% in 2016), Anglo-American institutional investors are requesting more independent board members and greater gender diversity. In 2014, Japan announced the implementation of the Corporate Governance Code based on the UK code. Although the Japanese code does not explicitly set female board director quotas, it does require at least two outside directors. The result is that Japanese firms appoint female outside directors to meet both requirements.

In December 2021, the Hong Kong Stock Exchange published conclusions on their review of the corporate governance code to include new rules to end single-gender boards. The existing listed issuers will have a 3-year transition period to comply by December 31, 2024. For IPO applicants, compliance is from July 1, 2022. Numerical targets and timelines must be set for gender diversity at the board level and disclosure must be made on gender ratios in the workforce. In addition, HKEX corporate governance code was also updated to improve board independence related with INEDs serving more than nine years (Long Serving INED). Additional disclosures are required to prove that the Long-Serving INED is still independent and could be re-elected; and companies should appoint a new INED if all INEDs are Long Serving INEDs.

It's more likely that firms with higher foreign active shareholders will promote the international standards of corporate governance, which means more board independence (INEDs) and diversity. Alongside of the HKEX governance code amendments, firms may nominate female INEDs to fulfill both requirements in one appointment.

Taking Action

What would be the most important suggestion for companies? Be proactive! The direction is clear – investors, shareholders, regulators, clients, employees, and society as a whole expect to see diversity on boards. It is not necessary to wait for rule changes or quotas to get ahead of these issues. Take the increasing trend of gender or other diversity requirement into account and develop a plan. Initiating board discussions about director succession can help to focus minds and drive action.