The asset management industry has found itself somewhat short on leaders. Relative to other industries, it has not positioned leadership development and talent management as top-of-mind agenda items, probably because there was no burning platform to do so until fairly recently. For a long time, asset managers enjoyed very comfortable margins, and the needs of running an investment firm meant top performance could be achieved with a team of experts at the helm (in either investment or sales).

The industry has changed, and asset management has become much more complex. Strategy, marketing and product management are important factors of success; much larger capital investments are required, leading to a need for scale that in turn demands the ability to manage large operations and IT platforms (and often M&A and integration capabilities); newer skills in areas such as data science and analytics, digital marketing and client solutions development, among others, are now key to leading the industry. Most importantly, investment firms need true general managers who can set out a strategic course, motivate teams, optimize resource usage and interface with internal and external stakeholders.

Asset managers can no longer thrive by external talent acquisition alone; they must invest in developing their internal talent pipeline—a big shift for them. Several major factors are forcing them to change how they think about talent. The first is that they have less money to work with. Due to thinning margins, firms can no longer afford to pick up and discard talent without thinking twice. They need to pay attention to their cost base and can no longer throw money at the talent problem.

Second, with more intense competition comes pressure to retain the talent they do have – and there again, money alone can’t address the issue, especially with younger generations. Third, the industry has lost some of its attractiveness relative to others, such as technology, health and sustainable energy, to name a few. Whether recruiting in new skills areas or attracting the general managers they need to lead them in the 21st century, firms face challenges that force them to develop some of those skills and competencies in-house.

However, most asset managers do not have the necessary talent development programs in place. In fact, we estimate that most investment firms spend between 10 and 15 percent of their HR budget on training and development, compared to 40-50 percent on talent acquisition efforts (i.e., internal talent acquisition teams and executive search).

A few firms have made the decision to invest in leadership development and are seeing it pay off. Larger institutions with scale are developing general managers by rotating executives across different roles to give them broader exposure to different functions or business areas. Others have been developing internal leaders by rolling product management, marketing and strategy into one function; this approach helps leaders build diverse skills by encouraging a customer-centric mindset and creating a “third leg of the stool” that starts them in the direction of consumer product companies, where business decisions are made outside of manufacturing and sales teams. Others have started to build true succession planning programs, which include rigorous assessment of the pipeline and thorough development plans. Unfortunately, these firms represent a minority of asset managers, and many have yet to make meaningful investments in their people and in their leaders.

How to Build a Culture that Embraces Leadership Development

Making this type of talent shift will be difficult, but asset management firms will reap the benefits if they can invest at the outset. We suggest that a good starting point is using a multi-faceted, continuous and adaptive approach to building a talent development culture.

Multi-faceted:

Asset managers should consider all of these elements in parallel as they begin to shift their thinking:

-

Hiring: When sourcing talent externally, recruit for the needs of tomorrow, not just for the needs of today. Hire for potential, not just for expertise. Look for employees who have broader skill sets, such as in strategy, management consulting and technology. Recruit for EQ, not just for IQ.

-

Integration: The on-boarding experience needs to highlight the focus on development, and to feature elements of culture and people, not simply job content and corporate rules.

-

Succession planning: For all senior positions, assess potential successors and design/implement tailored development plans for these executives in the succession pipeline.

-

Individual and team development programs: Each executive should have a specific development plan that focuses on competencies, not just experience, and that is supportive, not remedial. These programs should leverage unique strengths and address key gaps in parallel. The starting point is for the organization to identify the most important competencies for current and future leadership roles. Simultaneously, team development programs can be put in place to optimize how effectively they work together.

Continuous:

-

Asset management firms should adopt a culture of continuous improvement. No one, including the very best salespeople and investors, has ever truly accomplished all they can, and development should be a part of every executive's evolution at the firm.

-

Key to this culture is the acceptance and pursuit of feedback, both positive and constructive. Open, candid and frequent feedback is critical to a development culture, and the example should come from the top.

-

Programs to assess, shape and monitor the culture can be put in place to ensure progress in this direction.

Adaptive:

-

People learn and develop in different ways, so development should be tailored to individuals and their situations, and evolve over time.

-

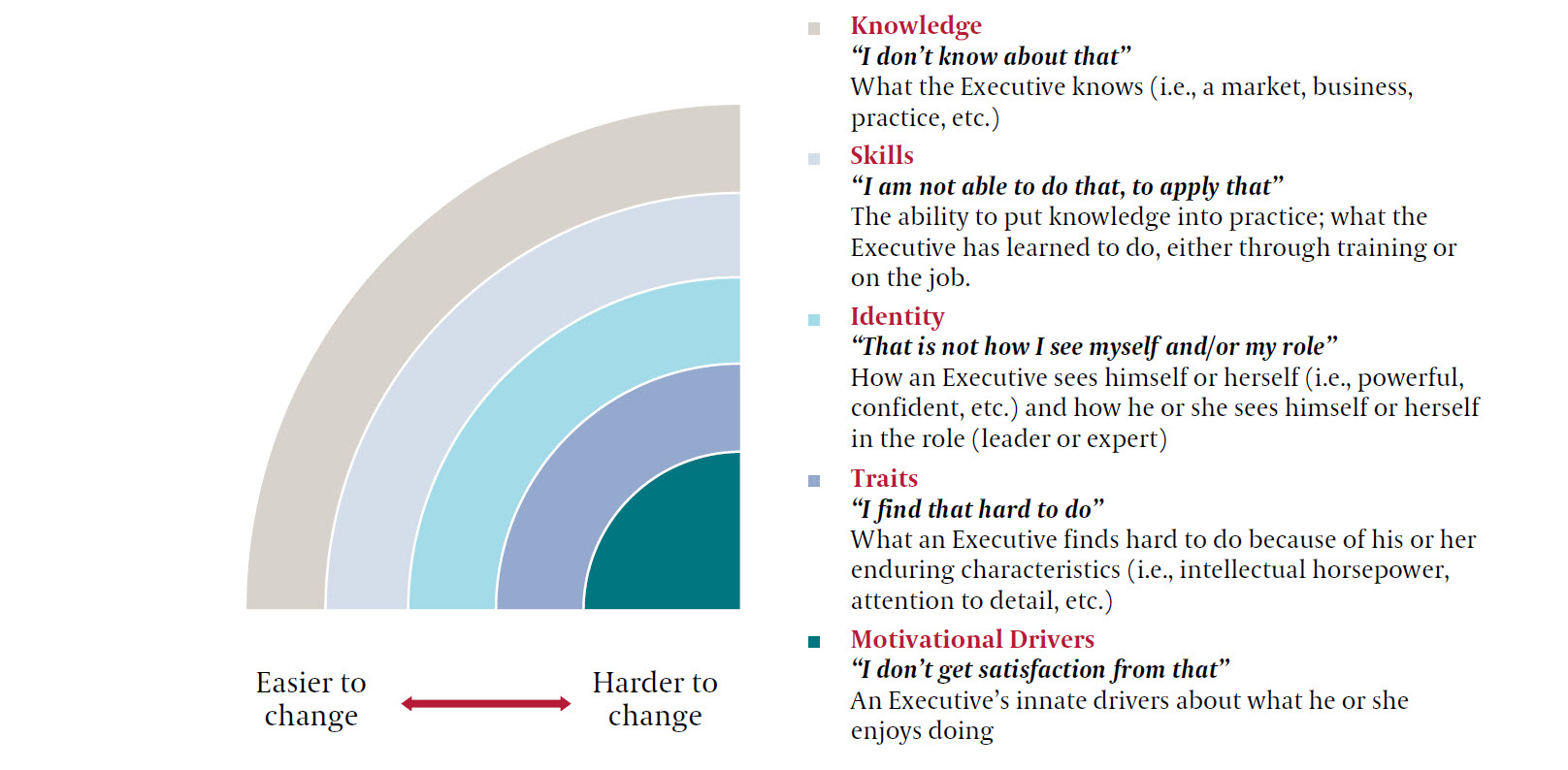

Likewise, the development plans should take into consideration the underlying root cause of development needs and include examining employees’ knowledge, skills, identity, traits and motivational drivers. The graph below represents the key root causes of the need for development, which of course impacts the way each need will be addressed.

-

A full suite of development options, covering experience, exposure and education, as well as coaching, should be available internally or externally to support those development plans.

-

Organizations should be brave in developing high-potential talent: providing stretch assignments and job rotations, for example, to build competencies. A project to implement a restructuring, relevant in the asset management industry today, or a P&L leadership role can have significant developmental impact.

In summary, the time is right for the asset management industry to invest in the type of leadership development capabilities that other industries have been putting in place for a long time. It is a matter of differentiation, of financial success and ultimately of survival.