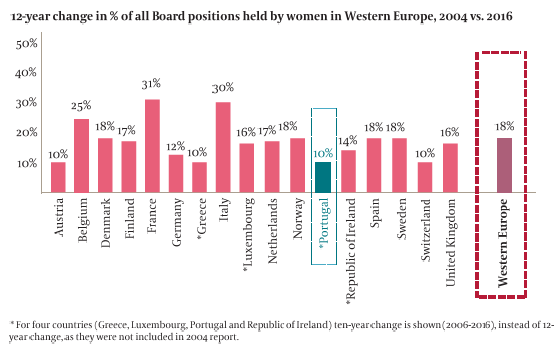

The trend is most positive in Western Europe where now 26% of all Board Members are women. Ten years ago this was a mere 8%. And there is a building body of evidence demonstrating that Diversity has a positive impact on the bottom line1.

Despite this momentum, progress is slow and is aggravated by a combination of low turnover in existing Board members and a limited pool of diversity candidates in the traditional feeder pools that yield qualified candidates.

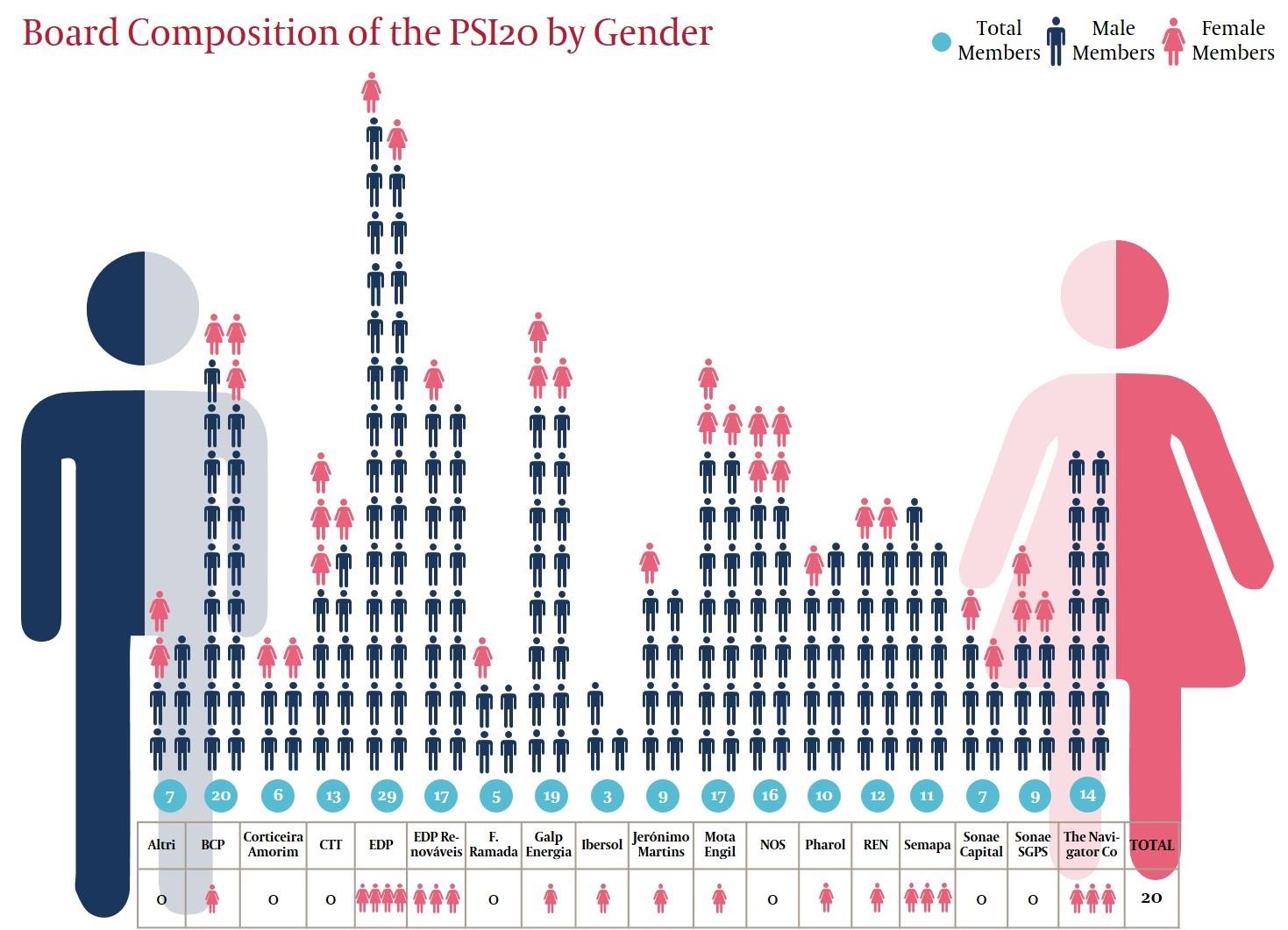

In response, regulators around the world are increasingly legislating quotas. Portugal joined this group in June of 2017 when it mandated that stock exchange listed companies have to have women representing 20% from among their Executive Board Members and Non-Executive Board Members starting in 2018. This increases to 33% by 1 January 2020. Failure to abide by these quotas exposes companies to financial penalties2. So how is Portugal doing? Not so well.

In our most recent study on Global Board Diversity, along with Austria, Greece and Switzerland, Portugal ranked dead last among Western European countries with only 10% of all Board Members being composed by women. On the other hand, Spain has grown from 10% to 21% after mandating quotas. Moreover, in 2016 only 9% of the new Board appointmentsin Portugal were women against a Western European benchmark of 18%. Only Greece fared worse3.

On the other hand, Portugal leads the way by having younger Boards, in both Men and Women, ranking third and first respectively against their Western European peers. It is also a country where we see a good mix of non-Portuguese Nationals (20%) on Portuguese company Board. So, it's not all gloom and doom.

Do quotas have an impact? In all countries that have instituted mandates, progress is evident. Some, like Italy and France, have made spectacular gains since introducing quotas. Others, like the UK, have gained through self-imposed rules. Thus, between regulators and powerful social forces, there is no doubt that these efforts are paying off. To some, the recen t enactment of quotas strike as an encroachment, an overzealous reach by regulators. Should we embrace this in Portugal as an opportunity or focus on seeing it as a challenge? What could be the scenarios for Portugal?

In our experience of advising clien ts around the globe on these issues, we have noticed a trend. Board Chairs, Heads of Nominating and Governance commi ttees and CEOs are seizing the drive for gender diversity as an opportuni ty to create 'Evergreen Board Succession Planning' while also meeting mandated Diversity goals. In combining these two themes there is a powerful business case for getting ahead of the curve.

In Portugal, early adopters who recognize this opportunity will have a first mover advantage - as explained below -in addition to bottom line, branding and customer benefi ts. So, what are the best practices underpinning Evergreen Board Succession Planning?

Without more regular Director turnover, Boards are unable to adjust their competencies to match the pace and extent of change in business today. Cybersecurity, Digital, AI & Robotics are just some of the themes that are overwhelming candidates, to include looking for 'disruptive forces' and 'intangible quallties' that make for a forward thinking Board. It also requires casting a wider net beyond 'the people we know', and conducting a more objective assessment when nominating external members. While this is not complex as an approach, it is surprising how few Boards apply a robust succession plan as a strategic advantage to get ahead of potential issues. As a result, regulators (such as the SEC) are mandating the disclosure of Board Succession plans following the 2008 financial crisis. This may be next on the agenda for the CMVM and is already on the ECB agenda for key functions (Risk, Audit, Compliance).

If this is the Roadmap of what we see as the Best in-Class example in Board Succession, where and how does Diversity support these efforts and address the Portugal's diversity goals?

In Portugal there are a couple of specific issues that make addressing this more complicated than just having the will to make it a priority. First, it starts with a limited number of candidates in traditional feeder pools (normally regarded as sitting CEOs and CFOs). The data is striking: at the end of March 2018 Portugal did not have a single woman CEO in the Lisbon Stock Exchange index. And while Portugal is not alone in this respect it does mean that Board Chairs and CEOs have to be creative in deciding how to solve for the gap in the talent pool. Second, in our analysis there is a need to name 20 women to Boards in 2018 and 47 by 2020. With a limited 'ready-now' candidate pool, this implies looking abroad, cultivating and grooming individuals from deeper down the organizational structures. Those who move quicker have a better chance to hire the best among the best.

Egon Zehnder is ideally placed to advise Board Chairs, CEOs and Heads of Nominating Committees on these efforts.

We are a world leader in Board and Diversity placements both in Portugal and abroad. We have made itour business to know the pool of relevant candidates: we understand their desires and know their skills because we have been in this market for almost 55 years. More importantly, no one knows better the existing talent at the N-2 level than Egon Zehnder. Given the need to go beyond the traditional feeder pools, we are best placed to co-create innovative solutions in Portugal. And with our international reach and experience we have the most well informed insight into the range of candidates outside the country, whether they are Portuguese Nationals residing abroad or otherwise.

In summary, Best Practices in Board Succession show that there is a lot to gain from adopting an evergreen approach. The timing of the regulator'smandated diversity quota clearly shows that there will be movement in addressing the composition of Boards across the listed companies.

Combining the push for Diversity with broader Board Succession planning has to be a priority in 2018 and beyond.

1. 2016, Global Board Diversity: Insights from 44 countries & 1491 businesses, available online at egonzehnder.com. See also "Why Diversity Matters" Catalyst, July 2013, and "Is Gender Diversity Profitable?" Peterson Institute for International Economics, February 2016.

2. For the relevant legislation see: Decreto No. 119|XIII, 23 Junho 2017

3. Egon Zehnder Research, 2016 Global Board Diversity Analysis