From embedded finance to digital lending and insurance tools, rapid advancements in technology are actively transforming how consumers and corporations view and interact with financial services. Critically, however, these unprecedented changes are being driven less by traditional BFSI institutions and more by a growing cohort of bold and innovative fintech and insurtech organizations, resulting in a constantly evolving market in which conventional service providers must find a way to both embrace and compete with these decidedly more agile, tech-savvy newcomers.

But how, more specifically, should banks and insurance companies be approaching the integration of technology and responding to this new competitive ecosystem? This was the primary focus of a recent session by Hemant Jhajharia, Head of Consulting for KPMG, at Egon Zehnder’s Directors Development Program. Hemant shed light on the various impacts of non-financial services (non-FS) entities on traditional markets, as well as what banking and insurance leaders should be focusing on to better adapt to our increasingly digital ecosystem.

Shifting Market Dynamics

Shifting Market Dynamics

While there is a considerable amount of complexity in terms of how new products and services are being created and delivered by fintech and other non-FS firms today, Hemant reminded us that the reason for their entry into the competitive landscape is comparatively simple: Customers are infinitely more educated about what technology can do and have largely come to prefer the convenience and efficiency of digital solutions, hence the success of projects like India Stack and the last decade’s explosion of digital transactions.

Turning to the more concrete impacts of the growing fintech sector, Hemant highlighted four specific areas where he believes market dynamics are shifting, the first of which is data. More specifically, he noted that whereas banks once had an advantage in terms of data ownership, they’ve not only failed to leverage that advantage effectively, but it has also gradually dissipated since the introduction of account aggregation.

“What the data banks had before aggregation was quite valuable, but I wouldn’t say they were using it well,” he said. “For example, SBI has troves of data compared to Google, but look at Google’s valuation and look at SBI’s. And the reason for this gap is because the market recognizes Google as a company that actually knows what to do with the data.”

Additionally, Hemant noted that customers in India and around the world today are increasingly regaining control over their personal data, due in large part to evolving regulatory trends, and this transfer of ownership has greatly complicated how customer data is acquired and utilized across industries. “Gone are the days where banks and insurance companies could claim they own all this data,” he said. “Now it’s all about consent, and the customer can give consent that even forces the bank to share their data through an aggregator framework with any lender. It’s not just in India; the whole world is moving toward this thought process that the customer owns the data.”

Other areas where market dynamics are shifting include networks, scale, and acquisition. According to Hemant, the move toward digital infrastructure has at once expanded banks’ and insurance companies’ access to customer relationships and made those relationships more competitive and complex. In other words, because technology has made it much easier for customers to access different financial services, their wealth and policies are increasingly being managed by multiple organizations.

“There are so many ways to transact today, and most customers no longer have what they would describe as a primary service provider,” he said. “And this is because relationships are simply no longer held by one institution, but instead there are multiple institutions fighting for that relationship and sometimes even expanding into each other’s turf.”

Up and Down the Acquisition Value Chain

Up and Down the Acquisition Value Chain

Diving deeper into the topic of customer acquisition, this is the area Hemant believes that traditional institutions should be most concerned about. More specifically, he spoke to the fact that digitalization has dramatically transformed the way both traditional and non-FS providers attract and onboard new customers, and that the advantage has in turn shifted to favor more technologically agile and less regulated fintech organizations, particularly those venturing into the realm of embedded finance.

“Historically, the way to acquire a customer was either they walked into your branch, or you reached out through different forums and accounts within the institution,” he said. “But now there are so many different ways to do it, the most interesting of which is embedded finance. For example, you could be checking out from Amazon and then you’re offered a loan product. Or you might be booking a trip, and you’re offered a travel insurance product. Everything is embedded and in either case all you have to do is click one check mark.”

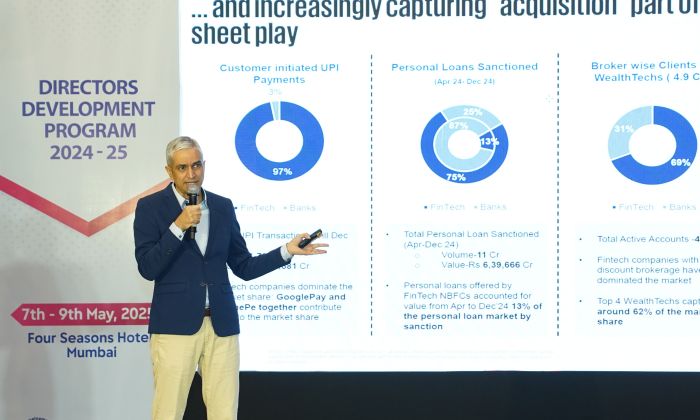

The most critical aspect of this shift, according to Hemant, is that it’s resulting in fintech and other non-FS providers increasingly capturing the acquisition part of the value chain away from traditional institutions. For example, he noted that roughly 25% of personal loans, upwards of 70% of brokering services, and 36% of new credit accounts are being delivered by the fintech sector today. And because the return on equity (ROE) for acquisition is generally much higher than that of capital deployment, banks could find themselves running into significant profitability risks down the line.

“It’s basically culminating into a slow attack, where over a decade or two you find that you’re left with only 70% of the business you had before, and it’s players in the fintech sector who will have eaten that cake,” said Hemant. “That’s what you should be worried about. Because if this keeps going on, your banking business might be left only with the more challenging and less profitable area of pure capital deployment.”

From Digital Channels to Digital Products

From Digital Channels to Digital Products

Despite the above challenges, Hemant does believe there are at least two strategies traditional institutions can deploy to better adapt to today’s complex landscape and proactively safeguard their acquisition value chains.

First, he suggests that banking and insurance leaders lean into the embedded model that has made fintech and other non-FS organizations so successful. And this requires understanding what it means to provide financial products and services in a way that seamlessly integrates with a customer’s lifestyle, as opposed to offering them in isolation and in the absence of real-time context.

“There is a very clear difference in what digital banks can do, particularly because the customer doesn’t have to move out of their comfort zone to go interact with financial services,” said Hemant. “The customer is doing what they’re doing, and the financial services product is embedded into their lifestyle. So, things like micro-insurance for travel and other sachet products will continue to grow in popularity. And on the embedded finance side, banks need to be able to offer payment services, lending, and banking services seamlessly within a platform rather than directing the user to a separate platform or application.”

Finally, Hemant highlighted the need for banks to reconsider how they’re approaching digitalization more broadly. For the most part, he explained, banks have focused almost exclusively on digital as a channel, which simply involves expanding access to your existing services through the broadening of your digital footprint, whether through the creation of websites or mobile applications. But what they should be focusing their attention is digital as a product, in which new services are created, and those new channels can then be leveraged as a cross-selling mechanism.

“I think the digital as a channel approach is something that we need to move away from, because there’s now an opportunity to take a P&L-centered approach where you actually create products for the digital ecosystem,” he said. “It can’t be your traditional personal loan or savings account. It needs to be a no-frills account and then you need a strategy to upgrade that, cross-sell wealth management products, for example, and build that portfolio. So, it’s really about creating a platform like that, and of course bringing in some fresh talent on the technology side. That’s the ‘digital bank within a bank’ model we need to be moving towards.”